Artificial Intelligence

How UK challenger bank Tandem is personalizing its mobile app

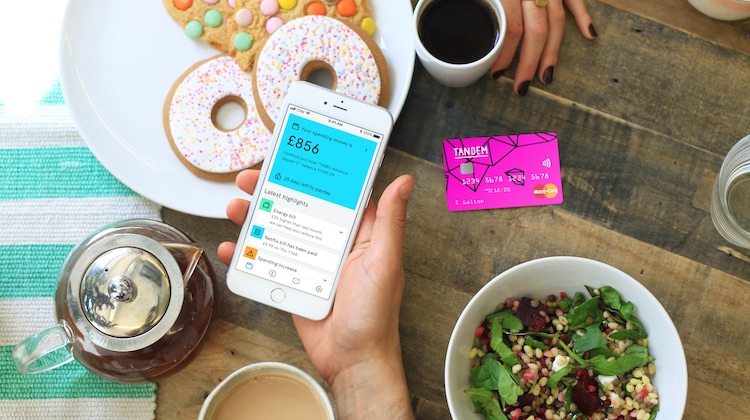

- Tandem Bank, one of the U.K.'s biggest challenger banks, is working with tech company Personetics to deliver personalized finance recommendations to customers based on data

- The move is the latest among U.K. challenger banks to 'own' the PFM space, adding pressure on incumbents to innovate