Artificial Intelligence

How Charlie Finance’s team of crack mobile game designers is working to fix personal finance

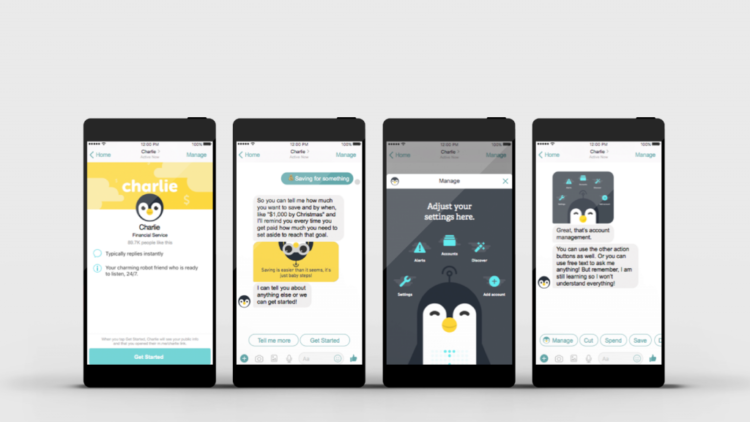

- Designed by gamers, Charlie Finance is a new type of personal finance tool.

- There's no app to download. Users interact with Charlie via text or Messenger.