Artificial Intelligence

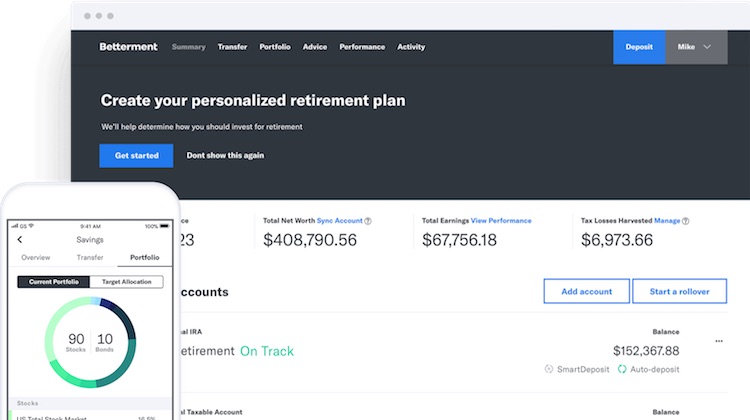

Betterment’s launches tool to optimize cash savings

- Millennials have 30 percent of their money in savings.

- Betterment wants its users to make more money on their cash.