The Payroll Effect: Turning wage flows into embedded finance opportunities

- Payroll is fast becoming one of the most direct, sticky, and impactful gateways for embedded finance.

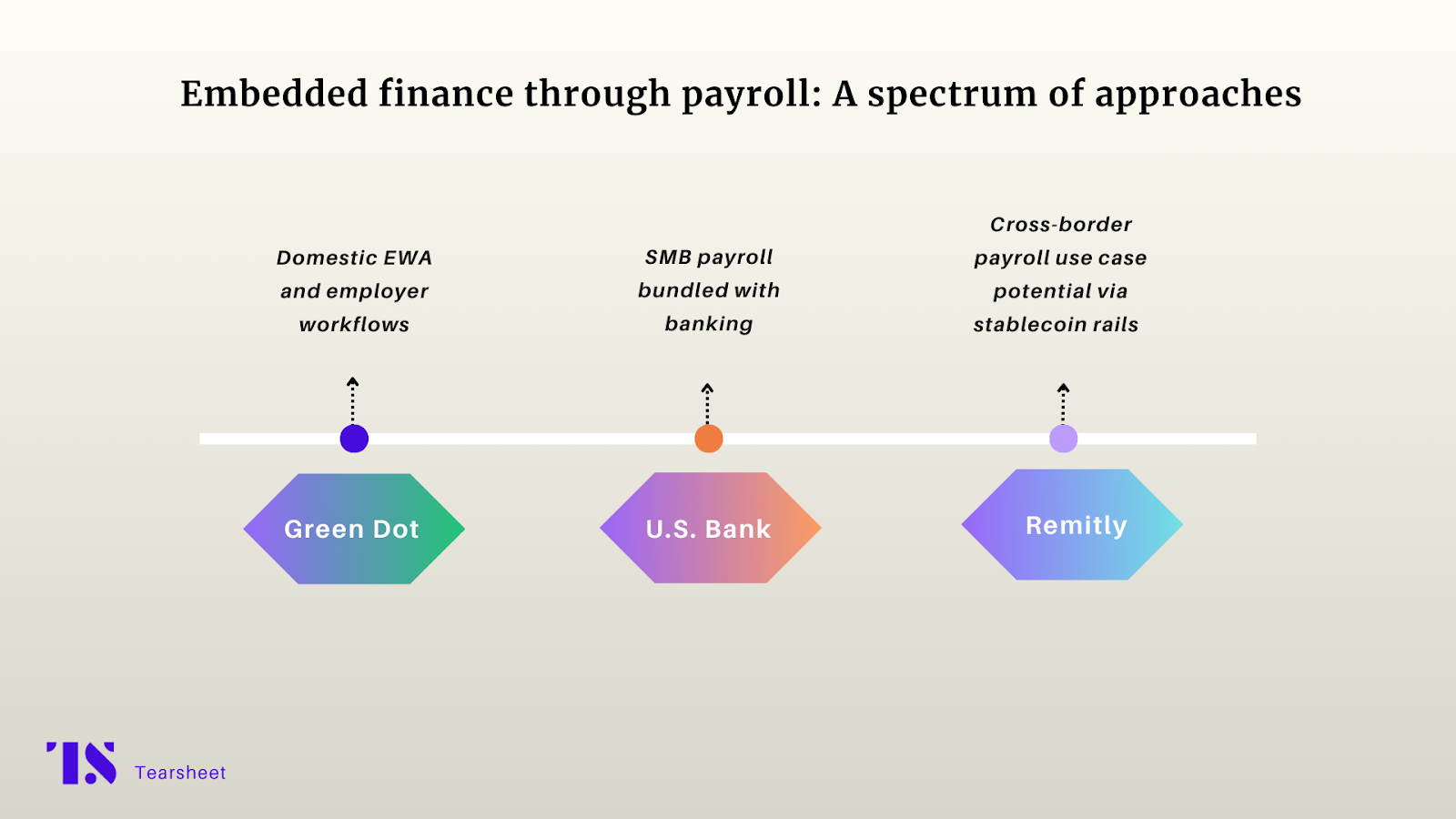

- Once centered solely on lending, payments, or banking, players like Green Dot, U.S. Bank, and Remitly are now leaning into payroll to drive embedded finance growth.

Historically, payroll has been viewed as a back-office chore that had to be done, but it was not considered an area for innovation. Now a shift is underway: payroll is emerging as one of the most direct, sticky, and impactful entry points for embedded finance.

Because it touches nearly every kind of business, from small independents to large enterprises, it serves as a powerful gateway for embedding financial services and delivering fresh value to employers and employees alike.

Financial firms that once focused solely on lending, payments, or banking as their primary touchpoints are now shifting their attention to payroll. Green Dot, U.S. Bank, and even the remittance-focused player Remitly are each leaning into payroll or payroll-adjacent flows as a way to expand their embedded finance ambitions.

Green Dot: Transforming wage payments into a financial hub

Green Dot has been building in the payroll payments space longer than most. The bank launched its rapid! solution in 2004 to streamline wage payments. Two decades later, rapid! has evolved from a payroll card solution into a broader platform connecting payroll with the digital payments ecosystem.

Today, rapid! offers PayCard, earned wage access, and disbursement solutions that serve over 7,000 businesses, covering scheduled paydays but also bonuses, tips, missed pay, and contractor payouts. That breadth matters. By embedding itself into every type of employer-to-worker disbursement, rapid! positions itself as a hub where financial access and operational efficiency intersect.

rapid!’s recent partnership with Workday, a cloud-based enterprise software provider for HR and finance, shows how Green Dot is extending payroll into a larger embedded finance play. Through direct integration, rapid! brings real-time pay and financial wellness tools into everyday workflows for both employers and employees, powered by Green Dot’s proprietary money-movement rails that deliver instant payouts to any US account. For end consumers, that means wage access that feels like table stakes; for Green Dot, it’s a distribution channel into the financial lives of millions of workers.

That infrastructure is solving for faster payroll but also positioning Green Dot to plug additional embedded services like banking, lending, and savings into the same rails. Payroll becomes the entry point, but the long game is an ecosystem of financial tools embedded directly into workflows.

U.S. Bank: Bundling payroll into SMB banking

U.S. Bank is taking a slightly different approach, targeting small businesses, which are often burdened by fragmented tools for payroll, banking, and operations. Last month, U.S. Bank and fintech partner Gusto launched a payroll solution that embeds payroll directly into the bank’s digital platform, giving small business owners one place to manage banking, payments, and payroll.

It’s been a long-standing ask from SMBs, and U.S. Bank’s survey confirms the strong interest: 80% of small business owners indicated a need for digital payroll solutions, and 81% prefer providers that bundle banking and operational tools.

The benefits of embedding payroll are both practical and strategic. Small business owners gain convenience and compliance support, while the bank strengthens its relationship with one of its core client segments. Payroll here is a recurring, indispensable process that keeps clients inside the U.S. Bank ecosystem, creating opportunities to cross-sell lending, treasury, or expense management solutions.

Remitly: Stablecoins and the payroll of the future

Known primarily for cross-border remittances, Remitly is experimenting with payroll-adjacent flows as part of its embedded finance strategy. The company recently partnered with Circle and Bridge to integrate USDC stablecoins into its wallet, enabling faster, more predictable value movement across borders.

While the immediate use case is consumer remittances, Remitly is starting to view stablecoins as an opportunity that extends beyond the consumer use case. The rails could eventually power the firm’s other B2B products, such as Remitly Business and cross-border payroll.

“We’re already piloting this in targeted corridors, demonstrating how stablecoins can extend beyond consumer remittances to become infrastructure for global payroll and cross-border business payments,” noted Ankur Sinha, Chief Product and Technology Officer at Remitly.

The infrastructure implications could be profound for payroll and global payments. Sinha explained, “The same advantages that make stablecoins compelling for consumers – instant settlement, predictable value, and lower payout costs – are equally powerful for SMBs, marketplaces, and global payroll platforms.”