Why AI maturity in financial services is as much of a technology story as it is a talent story

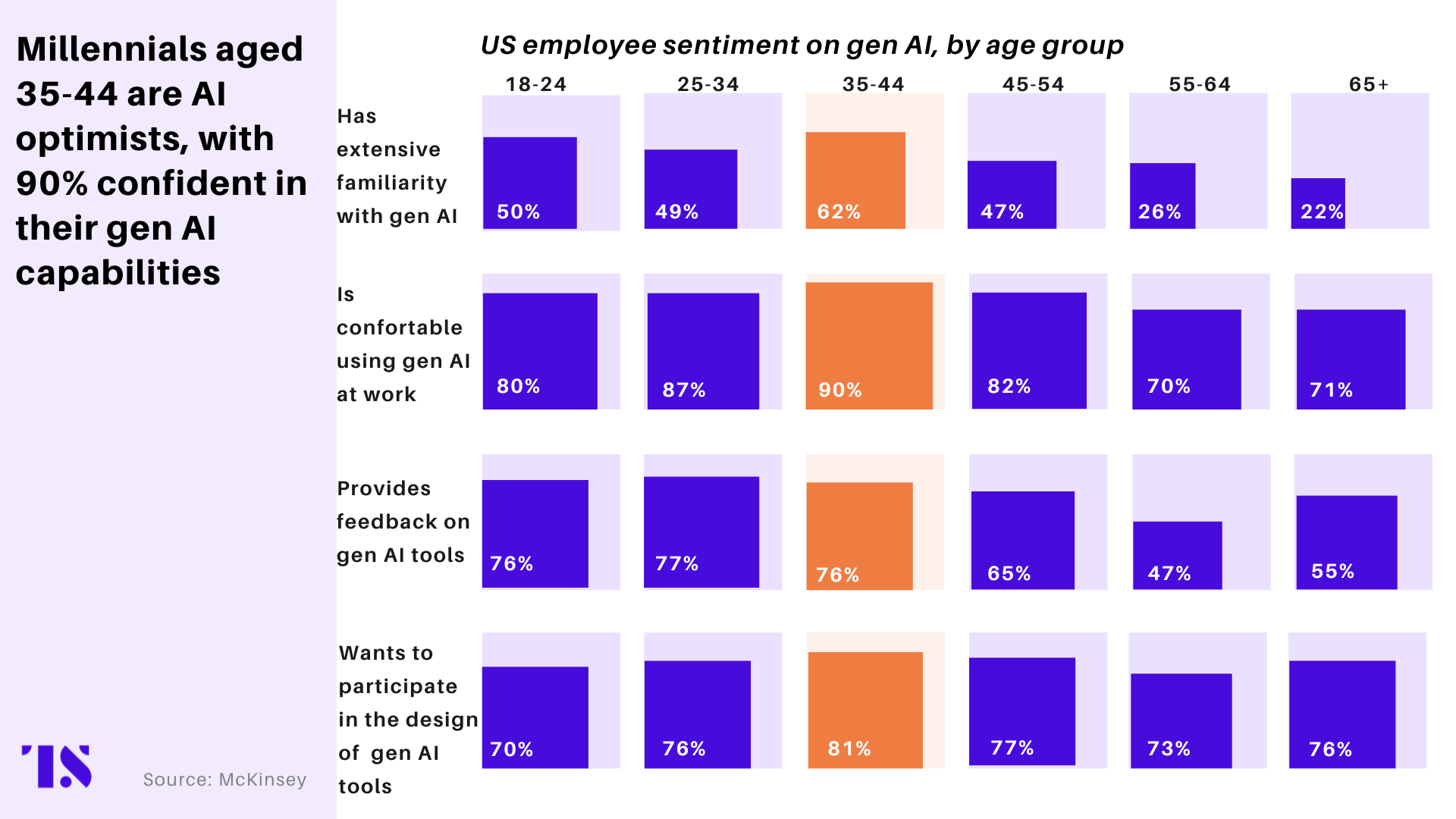

- Millennials, followed by Gen Z, are the most confident with generative AI, with up to 90% saying they’re comfortable using it at work, McKinsey reports.

- How can leading institutions and their C-suites harness Millennials’ confidence with AI to drive adoption, upskill teams, and stay competitive?

When we discuss the growth of AI in finance, the conversations often fixate on the technology itself: the algorithms, models, and automation. But an emerging perspective suggests that the pace of AI implementation can be accelerated by involving younger, digitally fluent professionals.

This observation is data-backed by recent research by McKinsey, which finds that Millennials, followed by Gen Z, are set to drive AI adoption across organizations because they’re the most confident in using AI tools. Up to 90% of people in both groups report feeling comfortable using generative AI at work. That’s because these young professionals are innately attuned to the tech’s paradigms in their personal lives. A 2023 survey conducted by Goldman Sachs also found that 86% of the firm’s interns use AI tools in their day-to-day activities.

The question here is, how are leading institutions and their C-suite decision-makers aligning with this reality? And how can they turn this trend into a competitive advantage as they navigate emerging technologies and invest in upskilling their teams?

Empowering the next-gen, anchored by the C-Suite

Employees are eager for companies to invest in AI training that propels their success.

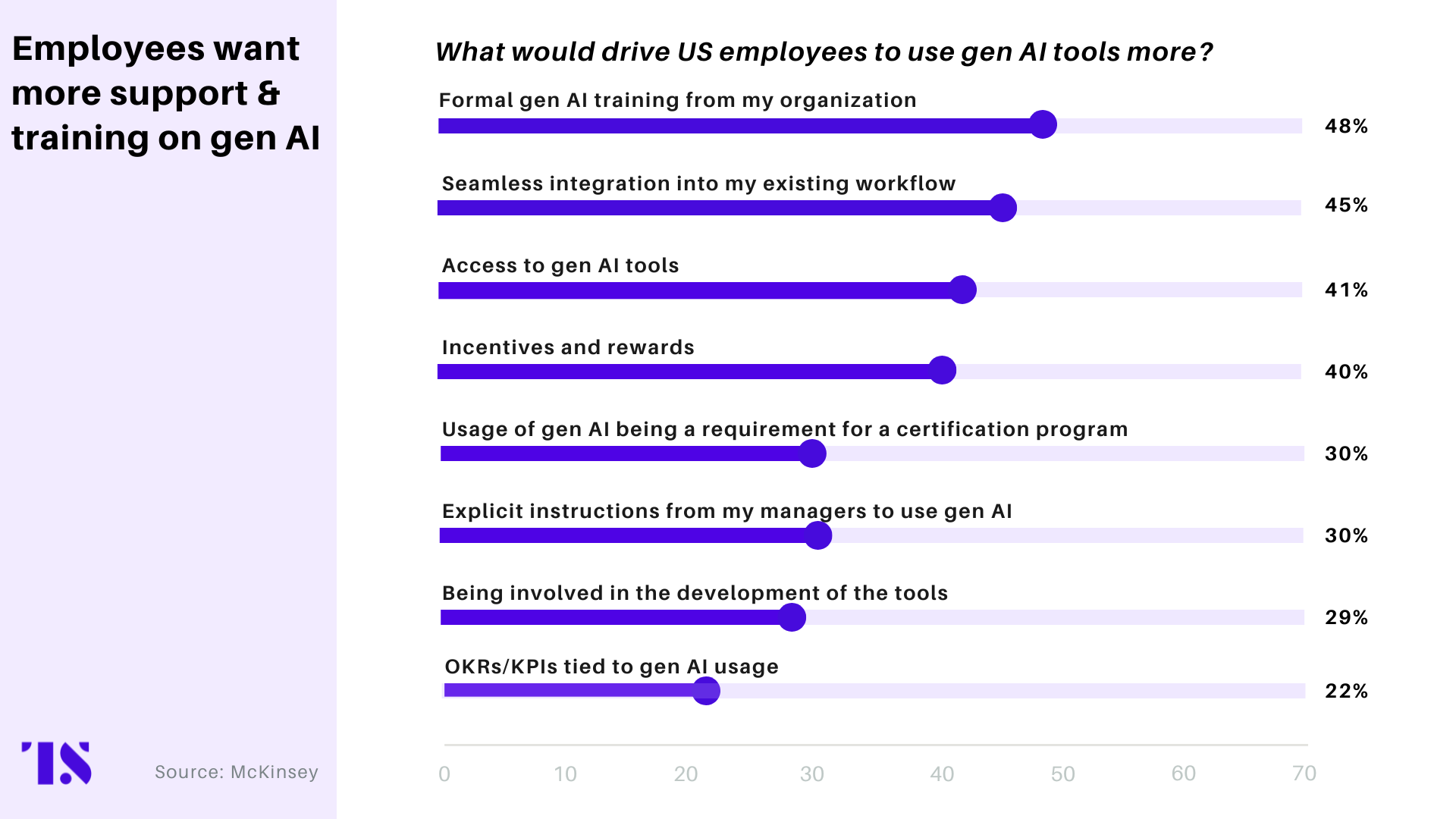

The research shows that nearly half of the employees are of the opinion that structured, formal training is the most effective way to accelerate AI adoption. Many also express interest in gaining hands-on experience through pilot programs or early-access tools. Additionally, recognition and financial incentives are seen as strong motivators to boost engagement.

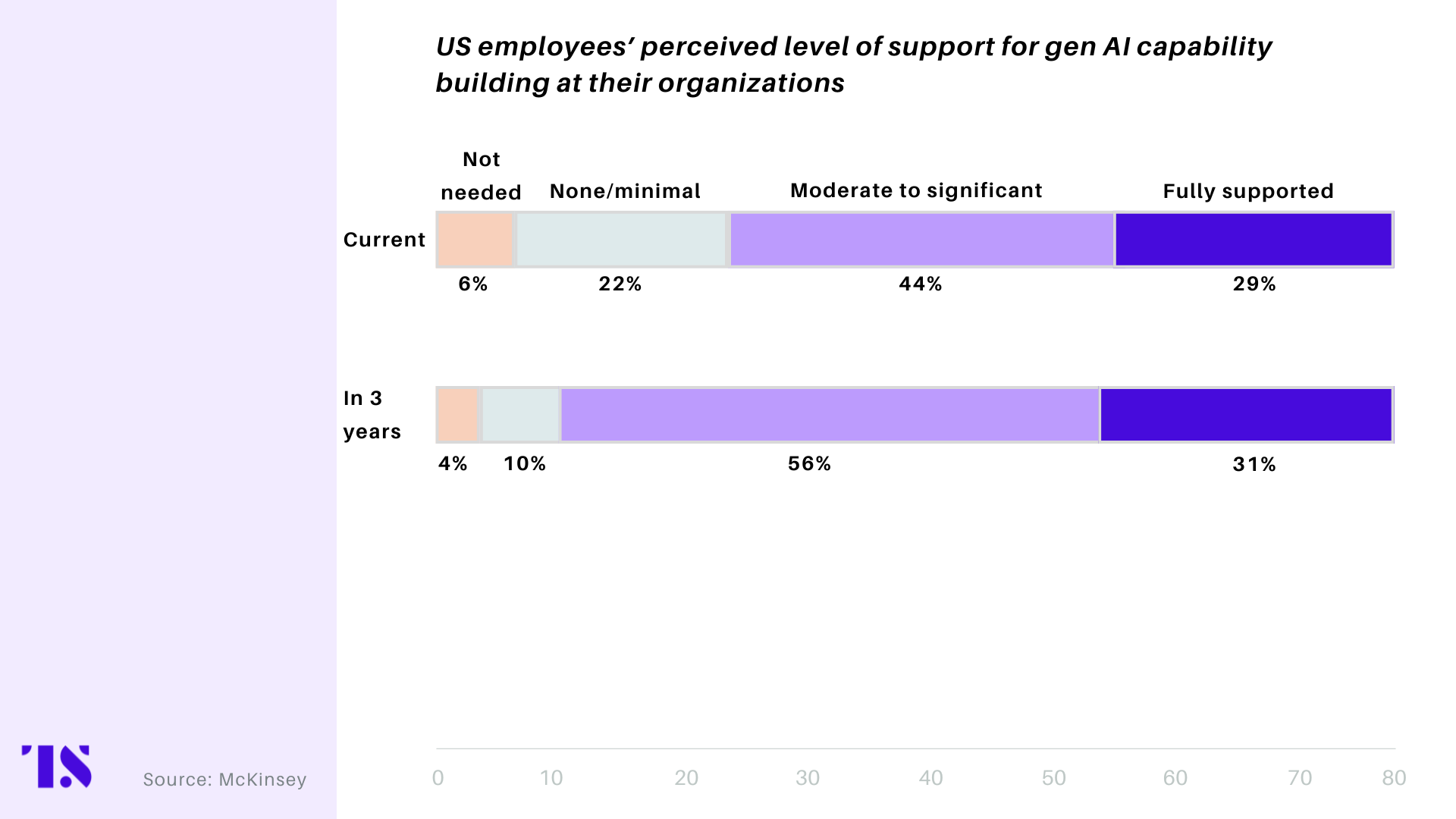

However, there’s a gap between employee expectations and reality. Over 20% of employees report receiving little to no support in building their AI skills.

So, what steps can organizations take to move ahead from here?

With many in managerial and leadership positions, Millennials could become key catalysts for AI adoption across organizations.

Millennials show the highest levels of AI experience and enthusiasm, with 62% describing themselves as highly skilled, even outpacing Gen Z.

Millennials’ dual roles – as tech-savvy users and team leaders – position them to champion AI on the ground. This also means the C-suite needs to back them and give them the room to grow and lead the way forward.

Stories from the field: Financial firms leading in AI adoption and those still finding their way

Among industry players, American Express is leading the way with early and proactive adoption of this mindset. Traditional banks, too, are moving forward, though in their typically cautious and measured way.

For incumbent banks, this transition is especially complex because they want to keep their trademark rigor intact while appealing to younger talent that often challenges their very traditional structures and deeply rooted hierarchies.

Banks in Focus: For the old guard, it’s not a simple plug-and-play

J.P. Morgan has been actively investing in upskilling its workforce for the AI era.

Last year, the bank laid out an ambitious roadmap, projecting around $17 billion in tech spending for the fiscal year, a figure shared by then-CFO Jeremy Barnum. Alongside ramping up its AI investments, the bank made a parallel commitment to its people: preparing its workforce for the evolving AI landscape. To support this, employees began receiving targeted AI training, including prompt engineering skills. “Everyone coming in this year will undergo prompt engineering training to prepare for the AI-driven future,” noted Mary Erdoes, who at the time led the bank’s asset and wealth management division.

Others like Goldman Sachs tend to favor a more deliberate and conservative path.

Internships have long been a foundational pipeline into the 156-year-old bank’s culture, discipline, and institutional standing. The program’s primary intent has historically been to initiate potential new hires into the basics of banking: understanding markets, modeling, client service, and navigating the structures that make a global bank tick.

The challenge now is holding on to its rigor while appealing to young professionals who want innovation alongside structure.

That means the bank had to reengineer what internships mean in today’s financial institution:

- Goldman’s summer internship program kicked off last year with 2,700 new hires out of over 315,000 applicants, which is a 0.9% acceptance rate. That exclusivity sends a signal that Goldman still commands elite interest.

- While the finance training is there, Goldman is also layering in hands-on exposure to technology, data, and AI every year. Interns are moving beyond the point of being mere observers; they’re embedded in real on-the-field teams, expected to contribute to client challenges and internal innovation projects. In areas like engineering and operations, many already work with tools that leverage AI to streamline workflows, predict market activity, or enhance client service.

There’s also a noticeable shift in who Goldman is bringing in. Around 40% of the 2024 intern class came from STEM fields. This is a reflection of how the bank is betting on technical talent to modernize its transformation. “Our interns work on real-world, complex issues for the firm’s clients,” said Omer Tanvir, Global Head of Campus and Diversity Recruiting at Goldman Sachs. Those “complex issues” in today’s world could very well involve parts of technology, data models, and emerging AI capabilities linked within the broader context of investment banking.

This evolution is part of a larger push within the bank’s AI strategy, which Tanvir described as a measured approach across three key pillars: Driving business growth and enhancing client experience, improving developer productivity, and increasing operating efficiencies.

In doing so, Goldman is walking a fine line: one foot in the structure that made it powerful, the other reaching toward the future its next hires expect and are eager to help create.

Beyond the banks: How an incumbent in payments is creating space for deep innovation and talent growth

American Express is leaning hard into AI through a different but complementary lens: long-term research and methodological innovation. The payments firm is further down the path of fully incorporating younger talent on its core AI team.

Anton Hinel, VP of Frontier AI Research and Customer Insights, explained how Amex’s Frontier Research Team functions as an incubator for AI breakthroughs, distinct from day-to-day production teams.

That’s because Amex sees the next competitive edge not solely in how fast it can apply AI, but in how deeply it understands the models it builds. From credit risk to fraud prevention to personalized marketing, machine learning is already embedded in the company’s workflows. But Frontier’s mission is to expand the ‘how’ – to develop methodologies that work across use cases, beyond just inside a single product vertical.

And increasingly, that means working with and hiring people who know AI tools inside out, but can also create new ones.

This is where Millennials enter the equation:

- Amex recruits PhD-level data scientists, research-minded engineers, and even graduate students through its academic partnerships with institutions like Imperial College London and Cornell University.

- These are intellectual collaborations, involving co-authored papers and mentorship models where researchers work on real Amex data.

- By giving them the space to experiment with concepts like automated data preprocessing, time-series modeling, or anomaly detection in real-world financial contexts, Amex offers something few legacy firms can: the chance to build foundational systems.

Take a recent project, where the Frontier team developed a method to automate the preprocessing of messy, irregular financial data – a notoriously complex and labor-intensive part of modeling for credit decisions. The endeavor resulted in faster model training, improved outcomes, and scalable tooling that can now be applied across fraud, credit risk, and customer insights. One of the key contributors in this solution was a graduate student whom the Frontier team met through their Imperial partnership, who later joined the Frontier team full-time.

It’s a case study in what Amex is building: a self-replenishing R&D loop that combines academic discipline with applied business relevance. This integration of academia and industry keeps Amex’s data scientists sharp, ready to translate emerging AI concepts into practical applications.

Why AI leaders and next-gen talent need to move in lockstep

AI advancement in financial services is as much of a technology story as it is a talent story.

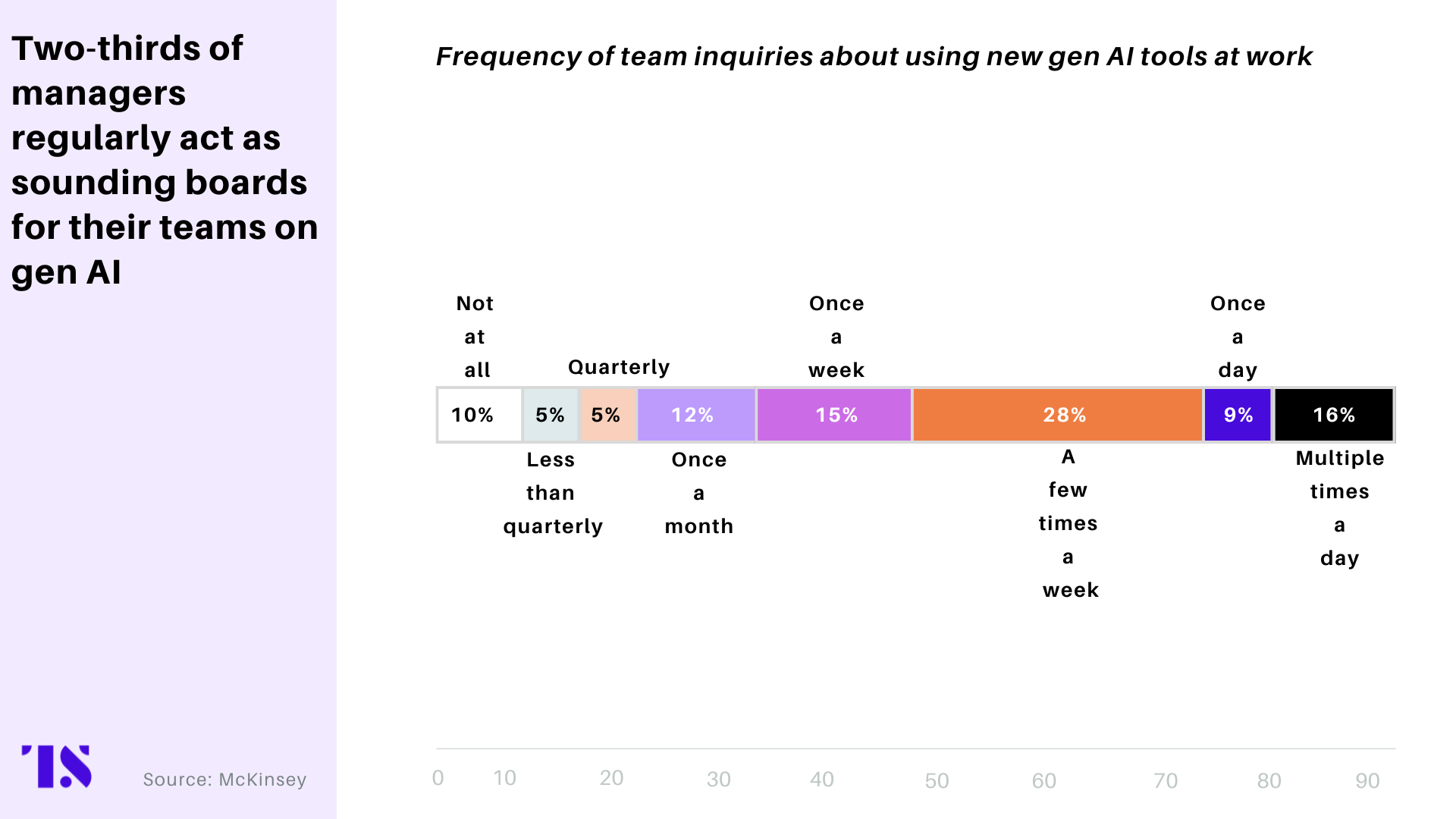

While the AI strategy in many financial firms is typically driven from the top down, data and real-world experiments suggest that some of the strongest ideas and momentum can also emerge from the bottom up, particularly in innovative tech divisions.

Taking a talent-first approach can flip the script and unlock advantages for financial firms:

- Innovation at speed and scale: Young AI-savvy professionals bring fresh perspectives and quick adaptability. Their fluency enables faster iteration on AI models and products.

- Bridging research and production: Amex’s Frontier team demonstrates how long-term AI research, operational scalability, and young talent can co-exist, ensuring new ideas move from lab to live environments effectively.

- Meeting customer and workforce expectations: The same generation pushing AI adoption internally also demands innovative, AI-enabled customer experiences, creating a virtuous cycle.