How Wise captured 25% of Brazil’s cross-border market (and what it reveals about fintech’s future in LATAM)

- While attention focuses on Western fintech markets, the most transformative innovations are emerging in Latin America, where countries like Brazil have built instant payment systems surpassing developed markets.

- Wise's Nadia Costanzo explains how the company captured 25% of Brazil's cross-border market through bank partnerships, revealing a collaborative model reshaping finance.

While attention often focuses on developed markets, the most exciting fintech innovations are emerging where mobile technology, young digital-native populations, and gaps in traditional banking converge. These regions aren’t just adopting Western models – they’re creating entirely new paradigms that may eventually reshape global finance.

Today I’m joined by Nadia Costanzo, Director of Banking for the Middle East, Africa, and Latin America at Wise. Nadia drives Wise’s expansion across these regions by building banking relationships, securing licenses, and navigating complex regulatory frameworks.

Her background is uniquely valuable – before Wise, she worked with Kiva in Nairobi facilitating microfinance across Africa, contributed to the World Bank’s Universal Financial Access agenda, and worked directly with microfinance institutions in Paraguay.

Today, we’ll explore how fintech evolves differently across emerging markets, examine key challenges, and discuss surprising innovations where traditional banking is limited. We’ll also consider what these developments mean for established financial institutions looking to engage with these dynamic markets.

Listen to the episode

Subscribe: Apple Podcasts I SoundCloud I Spotify

Watch the episode

Focused expansion in LATAM’s diverse markets

Latin America is often viewed as a unified market, but Nadia breaks this perception. Each country presents unique opportunities and regulatory conditions. Wise currently operates in Brazil, Mexico, Chile, Colombia, and Costa Rica. It prioritizes depth over breadth. “Whenever we choose a market, we want to be able to ensure that we offer our whole product offering to the customers over there,” she shares.

A key driver for Wise’s regional strategy is customer demand for cross-border services. In Brazil, Wise holds approximately 25% of the market share in cross-border transactions. “That’s because we’re offering a more convenient product. It is more transparent and less costly than traditional financial services,” Nadia explains.

Regulation and Collaboration: Navigating the fintech landscape

The regulatory landscape in Latin America is actively evolving, and Wise is growing with it. Countries like Brazil and Mexico are building open regulatory frameworks. These support the growth of fintech partnerships. They also enable new entrants to offer services independently. “You see how they’re modelling their regulatory developments on each other rather than looking only to the Global North,” says Nadia.

Wise recently secured its second payment institution license in Brazil. This granted access to PIX, the country’s instant payment system. Nadia points out that this has dramatically changed consumer expectations. “Brazilians wouldn’t understand why you wouldn’t offer PIX. It’s that embedded in everyday use now.”

Fintech and Banks: From competition to cooperation

Instead of direct competition, Nadia observes increasing collaboration between banks and fintechs. Wise depends on local financial institutions for payment execution in some markets. Those institutions rely on Wise’s international infrastructure in return. “Partnership has always been part of our model,” she says. “We offer something to them, and they offer something to us.”

This approach echoes the banking-as-a-service model. It is particularly useful for SMEs and micro merchants seeking digital tools for cash flow management. Banks are also responding by creating their fintech branches or collaborating with firms like Wise. They are doing this to reach digitally native customers more effectively.

Financial inclusion and digital accessibility

While Wise currently serves mostly banked users, the broader vision involves expanding access. “Hopefully that will change,” Nadia adds. She talks about reaching unbanked populations in LATAM. This goal is becoming more achievable as smartphone access and digital literacy grow.

The trend toward small business digitization is also contributing to greater financial inclusion. “People want extreme speed—instant payments, seamless transfers. That’s driving adoption,” she says. Wise’s presence is helping local economies, especially SMEs. It helps them to gain access to transparent cross-border tools. It bypasses traditionally complex and costly banking methods.

Building local teams, strengthening local economies

Wise’s model is deeply rooted in local presence. In Brazil alone, the company has over 200 employees. “There’s no one who knows the ins and outs of how to operate in these places like local people,” Nadia emphasizes. Local hiring ensures that Wise can navigate regulatory uncertainty. It allows them to better serve communities in line with cultural expectations.

She also highlights a growing fintech ecosystem in LATAM. It is supported by fintech associations. These allow players to share challenges and regulatory concerns collectively. This collaboration is essential to ensuring long-term growth. It ensures safety and cybersecurity within the region’s digital banking systems.

There’s more work to be done (and opportunities to grab)

LATAM’s fintech ecosystem is becoming more connected and user-focused. In response, Wise is expanding its services. They’re building strong infrastructure for cross-border payments. They are focusing on digital banking as well as support for small businesses. Wise has obtained new licenses and is forming stronger partnerships. This helps them expand their services across Latin America. They can now offer both global reach and local understanding to their customers.

As Nadia notes, the work is far from over. “I’m excited to bring our global products to customers in the region,” she says. And with 2 million cards issued in Brazil alone, the appetite for better financial solutions is clear—and still growing.

The Big Ideas

- Each LATAM market is a unique opportunity. “We tend to go deep in the markets that we operate in.” Wise targets specific countries rather than treating LATAM as a homogenous region.

- Regulation is opening doors. “You see how they’re modelling their regulatory developments on each other.” Governments are enabling fintechs through open payment systems and licensing.

- Fintechs and banks need each other. “We need partners, but increasingly, they also need Wise.” Mutual dependencies are shaping a new model of embedded finance.

- Financial inclusion starts with accessibility. “You need to have access to the banking system and a smartphone.” Current users are mostly banked, but Wise is positioning itself for broader reach.

- Local teams build better products. “No one knows the ins and outs like local people.” Hiring regional talent helps navigate unwritten rules and strengthens market fit.

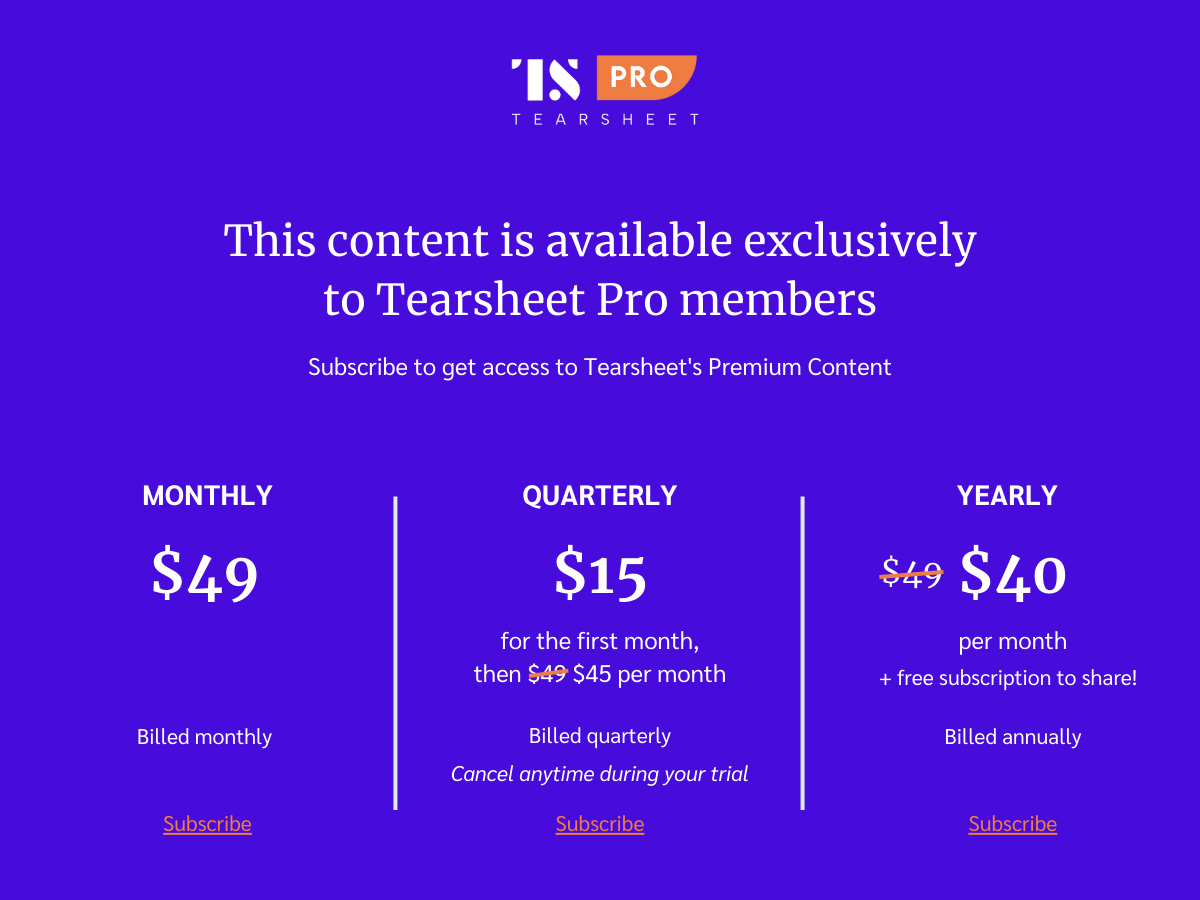

Read the transcript (TS Pro subscribers)