The call for Gen AI and why banks are slow to answer it

- While fintechs are rolling out AI-driven tools for wealth management and tax planning, banks remain cautious, focusing on internal productivity rather than customer-facing products.

- Apart from the compliance hurdles banks may be facing when it comes to deploying Gen AI, another reason for their slow movement may be the perceptions of their core consumer segment.

The room for automation in the financial services industry is huge and research by Citi finds that 54% of jobs in the banking industry could be impacted by Gen AI.

Within financial services, consultative services like wealth management and mortgage brokering may be the most vulnerable to disruption by Gen AI, says Matt Britton, CEO and founder of Suzy, a market research firm.

“When you talk about the financial services – particularly the services aspect – anything that’s consultative, that’s the first place AI is going to go. Mortgage brokers, wealth managers, accountants, those are areas AI is just built to be able to disrupt,” he said on a recent Tearsheet podcast.

One major reason for this is the expense that comes with hiring human expertise in these areas, according to Britton.

“[Employees are] so expensive, especially for SMBs, and 99% of the things that they do are highly templatized. Sure, there are going to be that 1% of cases where, if someone’s selling their company, they wouldn’t want an AI lawyer. But 99% of SMB-owners are going to seek AI-driven services because it’s just cheaper, faster, and more efficient.”

Gen AI’s entry into these services is already well underway:

- Tax Management: Intuit’s Gen AI financial assistant integrates across its product line, including QuickBooks and TurboTax to help customers file their taxes easily and comprehensively.

- Accountancy: Fintech Lili recently deployed a Gen AI tool called Accountant AI that will help its SMB customers with finding out answers to common accounting-related questions, as well as other tasks like budgeting.

- Insurance: Lemonade has created bots that create custom policies and help with claims processing.

- Investing: Public’s Gen AI powered assistant Alpha provides market trends, answers questions, and assists its users to do investment research. It’s set to become a major part of the firm’s strategy for the future, according to its CEO, Leif Abraham: “Currently Alpha, our AI assistant, is solely used to provide insights into the markets, public companies, and other assets. In the future, Alpha will expand to help people manage their portfolio. Moving Alpha from an assistant that gives context and information, to an assistant that can take action. This next phase is about integrating Alpha into that experience.”

Traditional FIs, on the other hand, have yet to take on a Gen AI strategy that centers around customer-facing products. And while most banks are steering clear of using AI assistants powered by Gen AI, they are more open to using it in the back office to help make their current employees and teams more productive.

Banks are using Gen AI to boost productivity

In July, JPMC introduced a new Gen AI powered tool to its Asset & Wealth Management team which the bank said could perform the tasks of a typical research analyst. The bank is gradually exposing more and more of its workforce to the tool, and an internal memo shows it’s encouraging its employees to use the tool for tasks like “writing, generating ideas, solving problems using Excel, [and] summarizing documents.”

Morgan Stanley has also launched its AI tool called Morgan Stanley Debrief, which helps financial advisors with creating notes on a meeting with a client.

Using Gen AI to increase productivity rather than build new products is a quintessential bank move. But apart from the obvious reasons like regulations and uncertainty, there may be another reason why banks are not moving faster with deploying Gen AI in client facing interactions.

Older folks aren’t keen on Gen AI

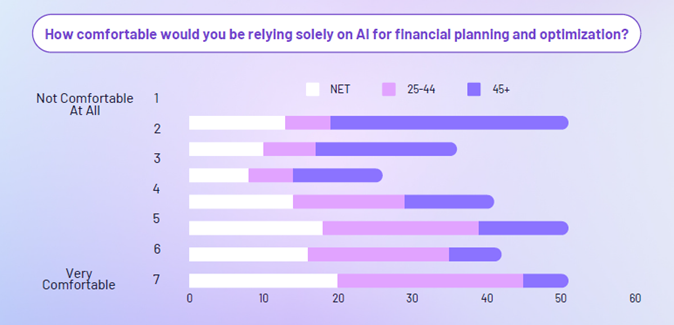

Suzy’s research shows that younger consumers are a lot more comfortable with using AI for financial planning and optimization than older consumers.

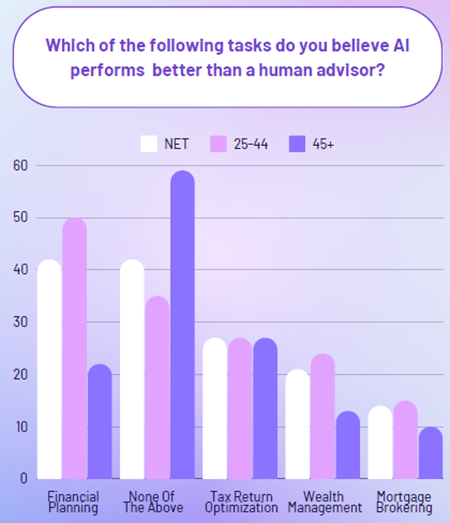

The trend repeats when consumers are asked which financial tasks like tax management, mortgage brokering, and wealth management do AI perform better than humans. Close to 60% of older consumers report feeling that AI is not better than humans at any of these tasks, according to Suzy’s research.

The fact that a majority of older consumers don’t feel comfortable with AI nor trust the ability of Gen AI-powered tools to perform well in the areas mentioned is a problem for banks. In the US, 50% of the local banking revenue is generated by people who are fifty years or older, according to data.

The challenge for banks is clear: they must navigate a delicate balancing act between meeting the needs of their current, older customer base while preparing for a future shaped by younger, tech-savvy consumers who are far more open to AI-driven solutions. To stay competitive, traditional financial institutions will need to move Gen AI to the front of the office, and find a way to collaborate with fintechs and co-create what Gen AI powered products will look like.

If you want to read more about how AI is changing the role of banks, download this guide.