How to build an embedded finance program from the ground up

- Embedded finance programs can strengthen the bottom line and help brands capture more customers and business, and for most payments are the most common point of entry.

- But brands can go further and stack multiple embedded finance offerings to build a suite of products that is closely tied to how their target audience interacts with their products and services.

Financial products have become an integral part of strategy for retail brands, and for good reason: embedded finance allows brands to go from being behind the counter to connecting more deeply with how consumers spend, store, and save their money.

The embedded finance starter pack: Payments

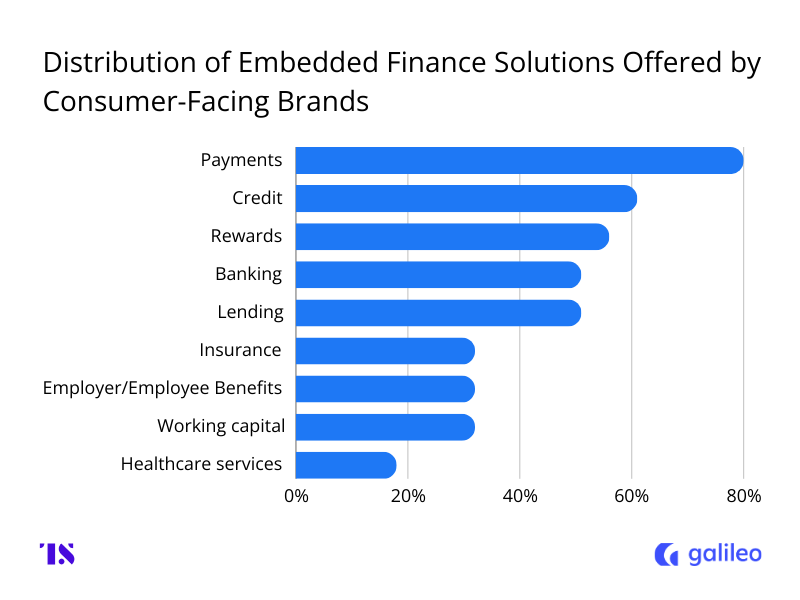

For brands looking to dive deeper into financial services, payment solutions are often the most common mode of entry. Currently, 80% of consumer companies report offering payments-related products, 61% report offering credit and debit products, and 56% reporting rewards products, according to research.

There are a few reasons why payments are such a common first choice for brands looking to build an embedded finance presence, according to Paul Dunning, Senior Manager, Business Development at Galileo:

- The tech is already there: Payment systems have advanced significantly, and open APIs and third-party payment processors allow brands to integrate payment services without the need to create intricate infrastructure from the ground up.

- The profit margins look good: Payments present instant monetization opportunities through transaction fees, interchange income, and customer loyalty programs, offering a clear route to boosting revenue growth.

- Compliance hurdles are low(er): Unlike services such as lending or insurance, payments typically come with fewer regulatory hurdles, enabling brands to enter the market more quickly and with less risk.

But some brands are going further than payments and are earning customers’ dollars with other financial products like insurance — inserting offers to insure everything from mobile phones to air travel at checkout.

For example, popular digital bank Monzo’s Premium account comes with mobile phone insurance. Like Monzo, consumer-facing brands can also lean further into their customer experience and enhance it with offers that complement their core offerings, like Tesla does with car insurance and Petco with pet insurance.

“Consumer-focused brands looking to add embedded finance solutions of their own, realize the full value of this opportunity and that it isn’t quite as easy as simply launching a payment card or lending product and waiting for revenue and engagement to skyrocket. Instead, firms must take a strategic approach, carefully considering what types of financial services make sense for their business and customer base, and how such tools would best fit into the context of their overarching offering,” said Dunning.

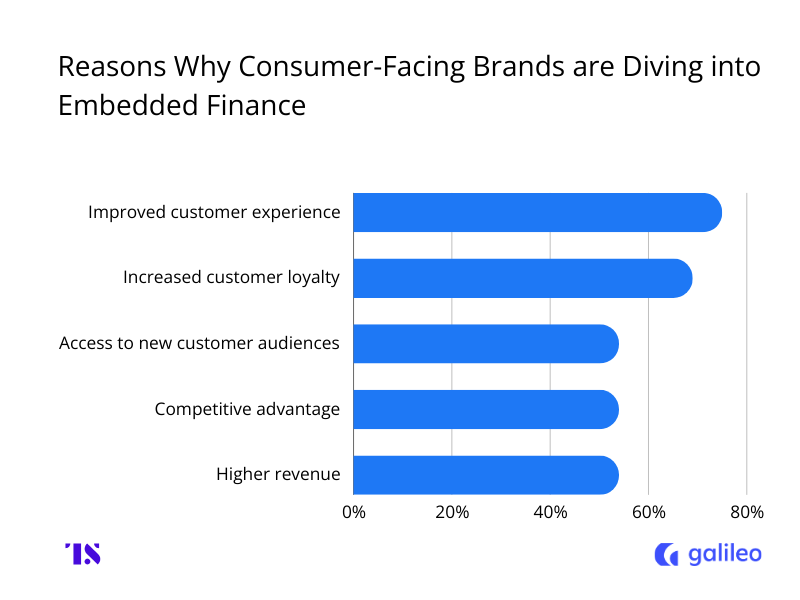

Most companies are planning to pad out their embedded finance programs with additional offerings, with 44% reporting that they plan to build on the current product suite in the next 6 months. Brands are interested in plunging deeper into embedded finance because it is helping them achieve multiple objectives: such as customer satisfaction, loyalty, and reaching previously uncaptured consumers.

How to take the next step

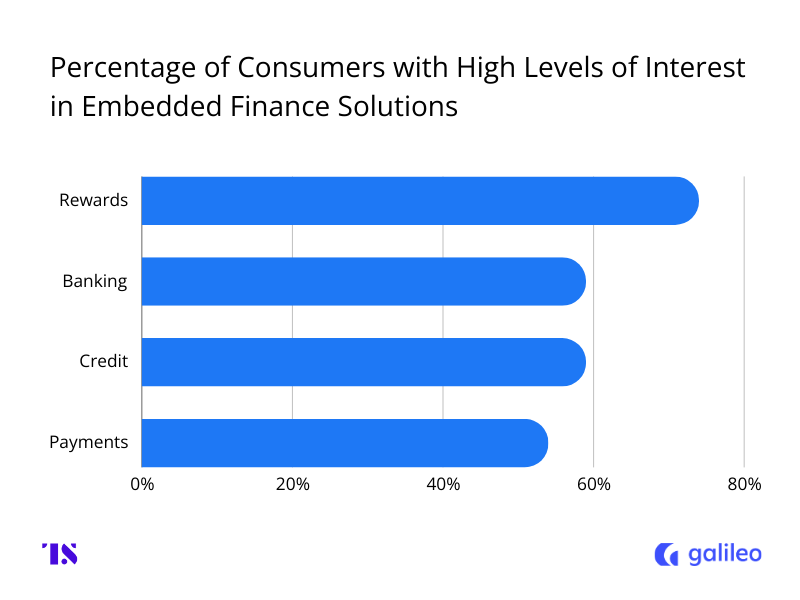

For firms that are thinking of maturing their embedded finance program, rewards can be the next step, because consumer interest in these types of products is considerably higher than others. 74% of customers rate rewards as their top interest compared to 59% who do the same for embedded finance products based on banking and credit.

Consumers have such a clear preference for rewards-based products for a few reasons, according to Dunning:

- Instant gratification: Earning rewards provides immediate feedback and distributes incentives like cash back, unlike banking products which generally take time to reveal their value and differentiation.

- Extra value: Rewards are perceived as bonuses, whereas banking products frequently include fees or limitations.

- Feels interactive: Unlike basic banking products, the element of rewards makes the experience fun, unexpected, and interactive, unlike the transactional nature of banking.

However, the recipe for success in rewards is about focusing on ensuring that the rules are simple enough for consumers to understand and the value consumers will receive is obvious from the get go – both of which build trust, according to Dunning.

How to build embedded finance programs efficiently

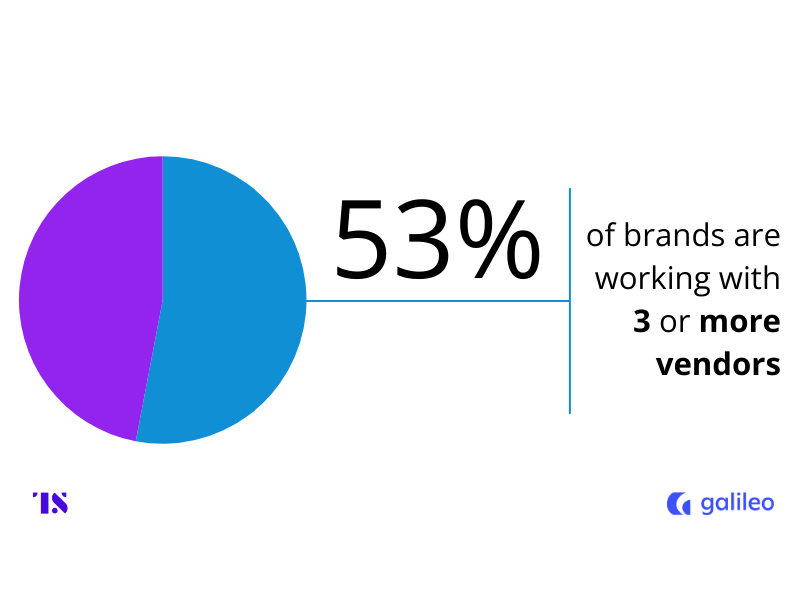

For many brands growing their embedded finance ambitions also means further complicating the sprawl of their relationships with their partners and technology providers. Currently 53% of executives report working with three or more technology providers.

When consumer-facing brands have to manage multiple relationships, they may start to face a some challenges, according to Dunning:

- Contract management: Managing multiple contracts with varying terms, pricing structures, and renewal schedules can quickly become overwhelming

- Data silos: Various providers may store and handle customer data in incompatible formats, creating challenges in consolidating information for insights or delivering personalized services.

- Duplicative costs: Handling multiple vendors can result in redundant expenses, services overlap, and inefficiencies in vendor management.

Brands can solve these problems by making mindful choices about their partners and choosing tech that supports their future ambitions. For example, they can optimize the structure of the embedded finance program by choosing partners that have a broader range of available services, use platforms that have unified APIs for multiple services, and build a data integration strategy that allow disparate systems to speak to each other and work together, said Dunning.

These proactive steps can help brands capitalize on the monetary benefits of building an embedded finance strategy while also ensuring their programs don’t strain internal resources.

Learn more about what objectives drive firms’ choice of technology providers and how brands can benefit from loyalty programs by downloading this guide.