Banking, Member Exclusive

Letter from the editor: Navigating the world of Earned Wage Access

- Earned Wage Access' popularity means it's becoming table stakes for many consumers as they select financial providers.

- We take a deep look at what's been happening in the earned wage space, EWA trends, EWA benefits, and more.

Benefits of EWA

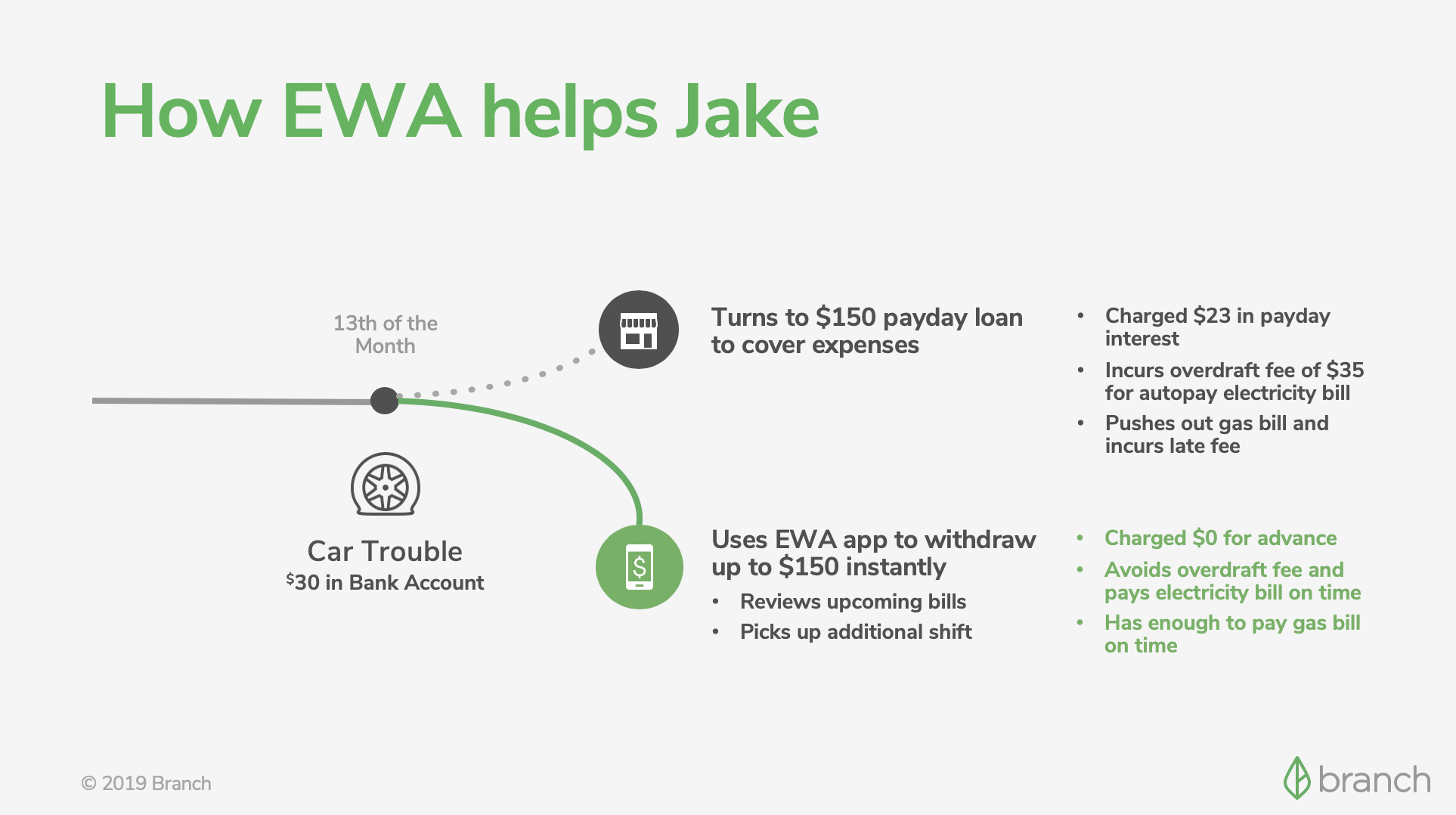

Americans spend about $170 billion a year waiting for their next paycheck. That’s in the form of payday loans, high-interest credit cards, overdraft fees, and other predatory financial products.

Earned Wage Access, or EWA, is impacting the way employees access their earned money. By allowing workers to access a portion of their earned wages before payday, EWA offers fresh financial flexibility, untethered from the constraints of traditional pay cycles and a positive input to financial empowerment.

How Earned Wage Access Works

Employees can request an advance on their earned wages through EWA platforms, often accessible via mobile apps. Once approved, the funds are deposited into the employee’s bank account or onto a prepaid card.

Trends in the EWA space 2024 and beyond

- Integration with Payroll Systems: EWA providers are increasingly integrating their platforms with employers’ payroll systems to streamline the process for both employers and employees. This integration allows for real-time tracking of worked hours and wages earned.

- Expansion of EWA Providers: More companies are entering the EWA market, offering various features and pricing models. This competition is driving innovation and improving options for employers and employees.

- Regulatory Scrutiny: As EWA gains popularity, regulatory scrutiny has increased. Some jurisdictions are considering or implementing regulations to ensure that EWA services are fair and transparent, protecting employees from potential exploitation.

- Focus on Financial Wellness: EWA providers are increasingly focusing on financial wellness beyond just providing access to earned wages. They offer financial literacy resources, budgeting tools, and savings features to help employees manage their finances better.

- Employer Adoption: Employers are recognizing the benefits of offering EWA as a voluntary benefit to attract and retain talent, improve employee satisfaction, and reduce financial stress among workers.

- Shift Away from Traditional Payday Loans: EWA is seen as a more ethical alternative to traditional payday loans, which often come with high fees and interest rates. By providing access to earned wages at a fraction of the cost, EWA helps employees avoid costly debt cycles.

- Expansion of Features: EWA providers are expanding their services beyond just early wage access. Some offer additional benefits such as financial planning tools, savings incentives, access to affordable credit, and even assistance with unexpected expenses like medical bills or car repairs.

- Partnerships with Financial Institutions: EWA providers are forming partnerships with banks and credit unions to offer additional financial services to employees, such as savings accounts, low-cost loans, and financial coaching. For banks, that means sticky deposits.

- Employee Demand: There’s a growing demand from employees for EWA services, especially among hourly and gig workers who may struggle with irregular income streams. This demand is pushing more employers to consider offering EWA as a benefit.

- Technology Advancements: Advances in technology, such as mobile apps and real-time payment processing, are making it easier for EWA providers to deliver their services quickly and efficiently, further driving adoption among employers and employees.