Four charts: Why consumers rely on banks rather than retailers for post-purchase issues

- Most customers like to go through their banks rather than knock on the retailer’s door, with 87.6% customers claiming they prefer their banks to cancel their subscriptions.

- Due to the role bank's play in customers lives, an unspoken relationship transfer takes place post-purchase, where its the bank that starts to own the customer rather than the retailer.

Even though customers go to retailers (or platforms) when they need to purchase a service or a product, when it comes to demanding a refund for a disappointing purchase or canceling a subscription, most customers like to go through their banks rather than knock on the retailer’s door. 87.6% customers claiming they prefer their banks to cancel their subscriptions, according to recent data.

Refunds vs. Disputes

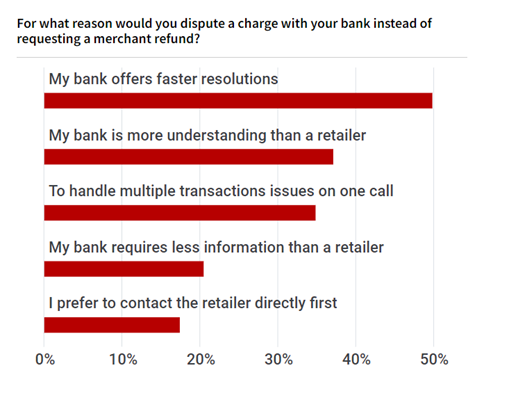

Retailers would prefer to own the customer even after the purchase is made, but if a customer is unable to receive a refund, they may dispute the charge as an alternative. 72% of customers report thinking that disputes are a valid alternative to requesting a refund from a merchant. This automatically shifts the customer relationship away from the retailer and brings it closer to the bank. From the customer’s perspective, calling the bank with which she already has a relationship with is easier than calling a retailer whose customer service may not be as accessible.

Customers’ preference to work with banks on chargebacks is also exhibited by the fact that 70% people are at least ‘satisfied’ with the disputing process, indicating that the way banks have structured their customers’ journeys is resonating with their clients.

Here, Capital One emerges as a clear winner in customer satisfaction when it comes to disputes.