From Chinatown roots to SoCal’s focus: How East West Bank became SoCal’s largest publicly traded bank

- We look at the story of how East West Bank came to be and evolved into the largest publicly traded bank headquartered in SoCal.

- what has likely driven East West Bank’s growth from day one is its targeted focus on a niche demographic.

The tale of how a group of Asian Americans chose to defy the norms in 1973

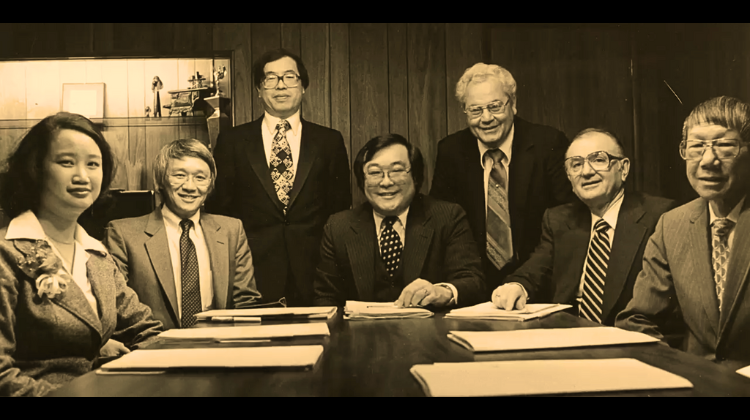

When mainstream banks fall short of serving minority communities or immigrants, these groups often face prolonged struggles, waiting for more inclusive solutions or settling for the bare minimum. But in 1973, a group of Asian Americans decided to challenge the status quo. They sought to address these unmet financial needs and took a decisive stand to change this reality.

Building a bank from the ground up was a formidable challenge for this minority group. To overcome obstacles, they sought support from friends and allies within the Italian American community to become part of the founding organization, as the government policies at the time did not acknowledge Asian Americans as bank founders.

This is the story of how East West Bank came to be, evolving into the largest publicly traded bank headquartered in Southern California, the 36th largest bank in the US by assets, and the biggest minority depository institution in the country today.

…