The Quarterly Review: Tom Bianco delivers on Newline by Fifth Third’s roadmap with AI tools and dashboard upgrades

- Newline by Fifth Third’s Tom Bianco aimed to improve the firm’s products, client experience, and brand awareness in April.

- In this edition, he is back in The Quarterly Review spotlight to report 3 AI-powered launches, 5 dashboard enhancements, and how his technical team came to the forefront in Money 20/20 to represent the firm’s value.

Notes from the desk: Hello and welcome to another review edition of The Quarterly Review, where I dive into what executives from some of the best brands in financial services are focusing on in this quarter. In the review edition, we compare the exec’s goals with results and see how well his plans stood the test of time.

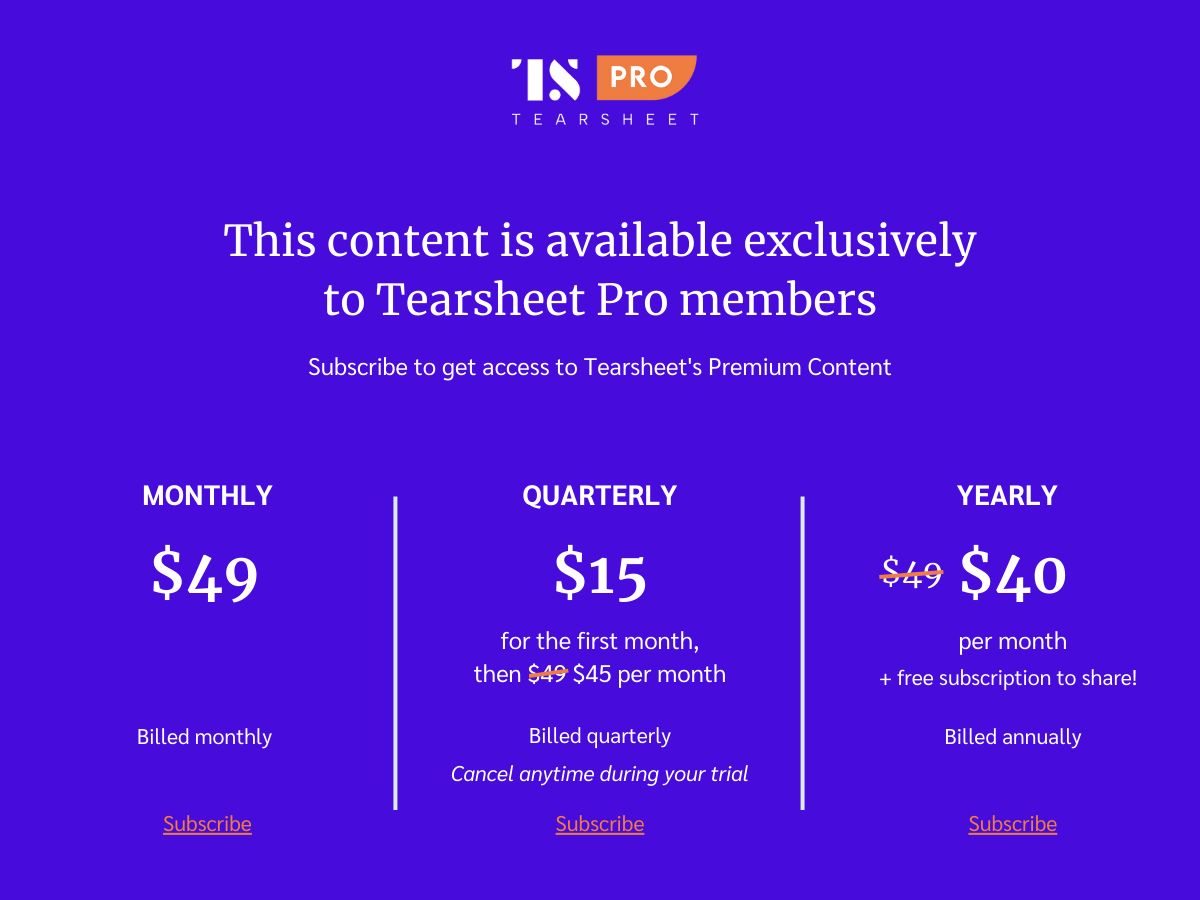

Our review articles in this series are an exclusive offering for our TS PRO subscribers. If you want to dive into the juicy stuff and read the details of their labors and fruits —beyond the executive summary below— please consider upgrading your subscription.

In this edition, we will check back in with Tom Bianco, General Manager at Newline by Fifth Third.

Executive Summary

Newline by Fifth Third plays a very important role in positioning the traditional bank at the top of the innovation and BaaS sophistication pyramid. My conversation in April with the GM of Newline by Fifth Third, Tom Bianco, revealed that the exec was intent on doubling down on this potential – through a three-pronged strategy that centered on improving products and program experiences, and building better brand awareness.

Here is how his goals panned out:

- Launched 3 AI-powered features that enhance developer efficiency, including conversational search, auto-synced documentation, and embedded AI assistance.

- Rolled out 5 dashboard enhancements that give clients better transaction visibility, testing capabilities, and direct access to support teams.

- Leveraged the experience of technical leaders and a Sandbox environment to showcase Newline’s capabilities.

The Full Review

Our review articles in this series are an exclusive offering for our TS PRO subscribers. If you want to dive into the juicy stuff and read the details of their labors and fruits —beyond the executive summary below— please consider upgrading your subscription.

In this edition, we will check back in with Tom Bianco, General Manager at Newline by Fifth Third.

Executive Summary

Newline by Fifth Third plays a very important role in positioning the traditional bank at the top of the innovation and BaaS sophistication pyramid. My conversation in April with the GM of Newline by Fifth Third, Tom Bianco, revealed that the exec was intent on doubling down on this potential – through a three-pronged strategy that centered on improving products and program experiences, and building better brand awareness.

Here is how his goals panned out:

- Launched 3 AI-powered features that enhance developer efficiency, including conversational search, auto-synced documentation, and embedded AI assistance.

- Rolled out 5 dashboard enhancements that give clients better transaction visibility, testing capabilities, and direct access to support teams.

- Leveraged the experience of technical leaders and a Sandbox environment to showcase Newline’s capabilities.