Fintechs and challenger banks have leveraged channels like TikTok, Instagram, and YouTube much more effectively and frequently than traditional banks.

To put this in perspective, JPMC, Bank of America, Wells Fargo, and US Bank all have a TikTok channel and official account on the platform but their pages have no content on them whatsoever. Only Citi and Capital One seem to have an active presence and strategy for this channel.

The absence of a dynamic and evolving social media strategy directly impacts how these banks connect with younger audiences. It’s a missed opportunity to build trust, recognition, and loyalty.

So what’s keeping the biggest financial brands in America from acting and building strategies for channels like TikTok?

A big reason for it may be the newness of it all, according to Kelvin Chen, Head of Policy at the Consumer Bankers Association, a trade association representing the retail banking industry. “It’s a new platform, and by virtue of that, it’s a little scary. The influencers that you’re working with all have relatively limited track histories,” he said.

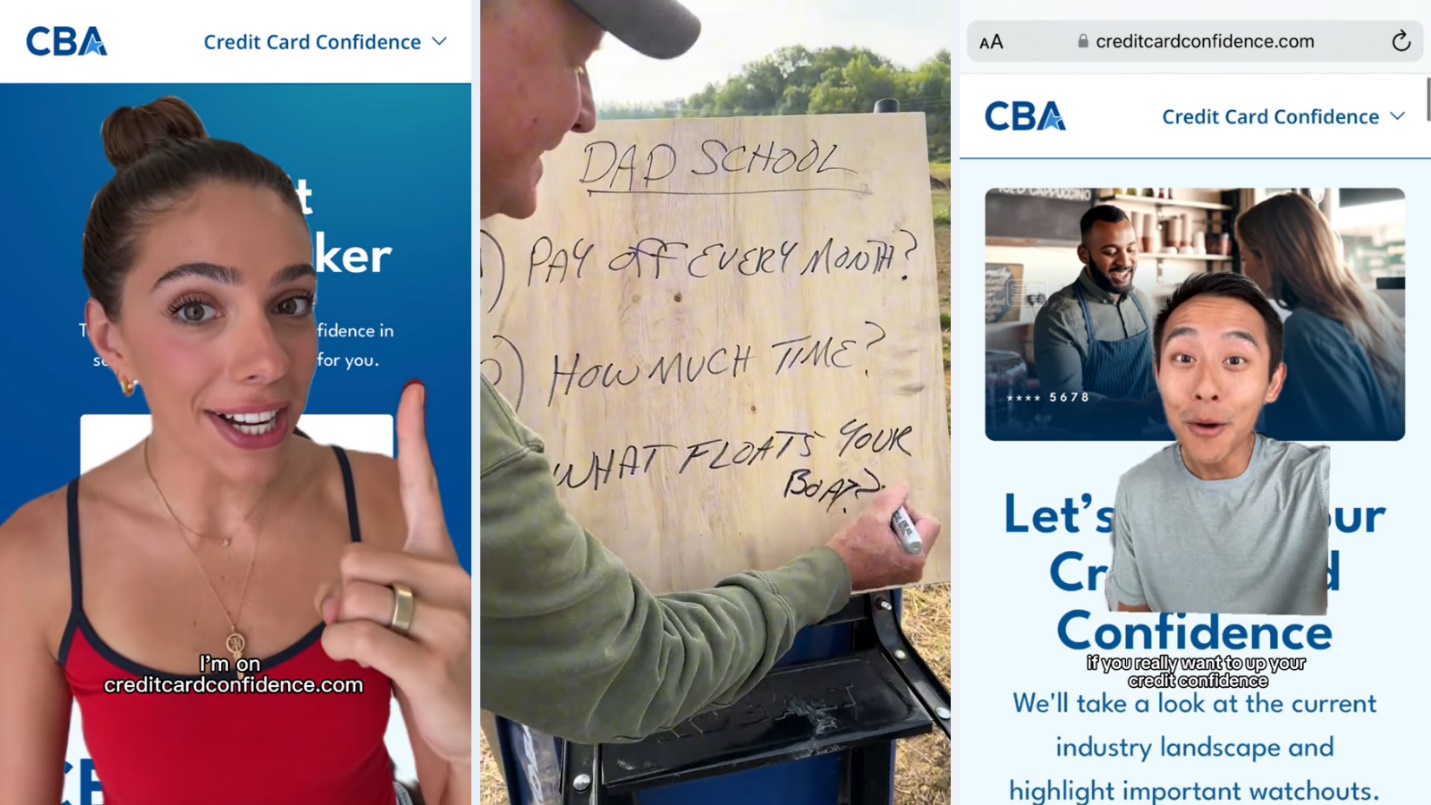

Despite the novelty, the CBA itself recently dove in headfirst and partnered with influencers for its Credit Card Confidence campaign. The campaign’s primary objective is to help consumers understand credit cards and their relationship with them better through answering three questions on the campaign website. Through this financial literacy campaign, the CBA aims to counteract some of the “bad rep” that credit cards have been getting in the media lately, according to Chen.

To maximize the campaign’s reach, the CBA has partnered with a number of influencers on TikTok and is using their videos to summarize the salient points of the campaign’s messaging and to redirect viewers to the campaign website. “Banks have sent 600 [million] pieces of mail a month to people’s homes, and that still isn’t hitting. Is there a different modality that might work?” said Chen.

The campaign and CBA’s process serve as a case in point for FIs that want to build a presence on channels like TikTok without rocking the regulatory boat.

Beyond this goal, the CBA is also hoping to get access to data and build a data team that would allow different parts of the organization like regulatory lawyers, lobbyists, and communicators to “to speak as one”, Chen added. Through the campaign the firm is also workshopping how to take insights from research and turn it into short form messaging. “The goal is to be able to take complex data driven messaging that’s heavily researched and turn it into a simple TikTok message, but to make sure that every word in there is airtight,” he said.

Building content that is trustworthy

The Credit Card Confidence campaign draws heavily from behavioral economics principles, and the questions on the campaign’s website have been green lit by experts in the government, consumer advocacy space, and the banks that the organization represents, says Chen. Unconventionally, the campaign doesn’t endorse or mention any specific credit card products or brands. The downside to this is obvious: beyond the advice, customers don’t have a direct and clear link to products that would suit their particular lifestyle and preferences.

But compromising on this last bit of experience allows the campaign to build a sense of trust and authenticity that feels untouched by advertising motives. It allows the advice to be truly product agnostic which can be important in an industry that has a “very heavy economy of lead generation”, said Chen.

While brainstorming the campaign, one of Chen’s mentors and an expert in the credit card industry said “I don’t know that anyone’s doing this well, because it’s all lead gen. Everyone has a particular set of products that they’re pushing consumers towards, and so, even if they’re well intentioned, it’s a limited set of products that they’re working with.”

Building content that is engaging

When it came to who to work with for the amplification on TikTok, the CBA chose influencers like John Liang (2.4 million followers) and Taylor Price (1.1 million followers), both of whom provide finance tips on the channel. Another influencer that the CBA has partnered with is Bo Petterson (3.7 million followers) who self-describes as a “regular dad teaching you what I taught my kids & fighting for my daughter’s cure”.

In his video for the CBA, Petterson can be seen standing in the middle of a field with his horses, summarizing the content on the campaign website and writing down the salient points on a board. Price’s version uses a popular short-form video format “Get Ready With Me (GRWM)” which usually involves the influencer talking while doing their makeup.

“There was an old-fashioned brand exercise where we asked if this is people’s first impression of us, what’s the feeling we want them to have about the CBA? We didn’t want to make it seem like we’re the old man in the shirt that’s too tight in the nightclub. At the end of the day, we really like Bo for instance – because we’re the old people in pleated pants, just trying to tell you what we know about life in a humble way,” Chen said.

All of the TikToks in the campaign clearly show that the video is made in partnership with the CBA, come with disclosures, and are intentionally less than minute long, he added.

How to measure success

The CBA is currently amplifying some of its videos with paid marketing, and its choice of social media platform depends upon the engagement analytics tools that come with the website to track the content’s performance. “We’re pulling in data, and we’re able to look at reshares, comments, and likes, and then see what’s working and what’s not,” he said.

At first Chen thought that views would be the biggest indicator of success, but as the campaign is progressing, Chen feels that some other metrics are more indicative of consumer opinion, especially given that the campaign isn’t built around tracking conversions to a particular product. So far, Chen reports that the campaign is nearing 10 million views, despite only being halfway through its run time. Metrics like bookmarks, reshares, and comments better express how much customers trust the content they are watching. “The thing that I love the most is that we have 700 plus comments and like, 3000 plus reshares… in my mind, there’s no better validation than someone saying, hey, I saw this and I thought this was interesting. I’m going to send it to my mom or send it to my friend,” he said.

Social media channels like TikTok allow brands to actually see who is willing to promote their products and messaging, a thing that Net Promoter Scores only have a hypothetical estimation on. For institutions that aren’t on these channels, one issue is the possibility of their messaging getting drowned out in the sea of content.

Earlier this year U.S. Bank’s Head of Behavioral Science, Julie O’Brien said “… we can’t influence what people are exposed to, outside of our own institution. And I think that’s something that we have to think about. We’re only one voice out of many voices, that can be very powerful, in comparison.”

But the noise of social media isn’t a reason for FIs to avoid platforms like TikTok. It’s exactly why they should join in and build their own marching bands.

Sidebar: The fintech approach to influencer marketing

The sidebar is a member-exclusive section where we discuss stories that are tangential to the main story above. In this sidebar we will discuss some recent campaigns by fintechs that relied on influencer marketing and whether they achieved their intended purpose.