Hi 5! The five fintech stories we’re following this week

The Startups: Who’s shaking things up (Week ending January 31, 2016)

[alert type=yellow ]Every week, Tradestreaming highlights startups in the news, making things happen. The following is just part of this week’s news roundup. You can get these updates delivered direct to your inbox by signing up for the Tradestreaming newsletter.[/alert]

Startups raising/Investors investing

Is VC the right money for fintech? (TechCrunch)

Citi Ventures invests in working capital marketplace, C2FO (Finextra)

College Ave Student Loans scores $20m (PE Hub)

Blockchain Capital raises $13m for second fund (CoinDesk)

Leftover currency converter TravelersBox raises $10m (Reuters)

Social investing startup SprinkleBit raises $10m (TechCrunch)

Dopay, payroll company for the unbanked, raises $2.5m (PE Hub)

MIT spinout Insurify raises $2m to replace insurance agents with robots (TechCrunch)

The Startups: Who’s shaking things up

NYT: How roboadvisers stack up against each other (NY Times)

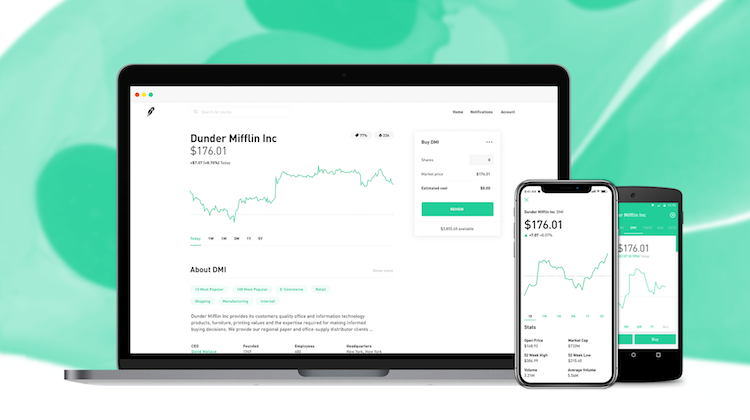

How Robinhood became the first financial app to receive an Apple Design Award (Let’s Talk Payments)

Robo-advisor Betterment launches business platform (Finextra)

Betterment, the largest automated investing service, is launching Betterment for Business. This comes the same week as President Obama is expected to introduce a budget plan making it easier for small businesses to form retirement plans for their workers.

Broken TransferWise all “smoke and mirrors”? (The Memo)

Moven partners with loan refinancers, Payoff and CommonBond (Bank Innovation)

Spare change investment platform, Acorns launches education site (Bank Innovation)

Tencent’s WeChat Wallet lands in Hong Kong, beating Apple Pay to market for mobile payments (South China Morning Post)

Robinhood ramping its free trading app via integrations, global expansion in 2016

Robinhood, still the posterboy for helping out the little guy, has traded in his quiver of arrows for some new thinking about how stocks should be bought and sold. For this current incarnation, the vision isn’t spreading the wealth by stealing riches from the rich, but by enabling everyman to trade stocks and ETFs online with no commissions. According to Robinhood’s Head of Communications, Jack Randall, “Robinhood launched at the perfect time: distrust in Wall Street had never been higher, mobile usage was rising rapidly, and the brokerage market was ripe for disruption.”

Bringing investment transactions into the age of the Internet

The story of commissions is tied to the history of stock investing: if you had a funded account at a brick and mortar brokerage, you could call your stockbroker who would then place an order through their representative on the trading floor of the appropriate exchange. In 1988, Ameritrade offered the first touch-tone entry system to place trading orders, and WealthWeb offered the first online trade orders in 1994. Flash forward to 2015: brokerage services like Capital One Investing and Firstrade offer trades with no initial funding requirement and charge $6.95 per trade. “Decades ago, there were large costs associated with executing trades. Tech wasn’t there, it was largely a manual process with people passing order tickets on the floor of the NYSE,” says Randall. Today, “paying to trade is like paying to send an email. It’s an electronic transaction, and one that consumers should not be paying for.”

The stated mission of taking “a complex system of regulation, financial institutions, and assets” and making the trading platform “simple, focused, and immediately understandable” seems to be paying off. Randall says, “The median age of a Robinhood customer is 28 years old. While we’re a wonderful tool for first time investors, 75% of our customers are not first-time investors. Robinhood is simple enough for first-time investors and sophisticated enough for more seasoned investors. Since we launched publicly in March, we have transacted over $2 billion through our platform. Also, our growth rate makes us the fastest growing brokerage in the world. (This is unique given we launched recently and were only available one one platform – iOS – until August when we launched our Android app.)”

Integrations key part of Robinhood’s expansion strategy

And it seems like Robinhood’s mission has only just begun. Since November, the educational investing platform Rubicoin and the crowdsourced hedge fund Quantopian both link with Robinhood accounts. The popular social trading networks StockTwits and Openfolio now integrate usage of Robinhood directly into their platforms. Apple just named Robinhood as one of ten apps on their Apple Design Awards for 2015 list. According to Apple, geolocation, Apple Watch integration and “thoughtful notifications” are key parts of the Robinhood app. “Designed to be the best mobile stock-tracking tool on iOS, Robinhood distinguishes itself with a clean, content-centric design and beautiful typography that nicely balances app branding and iOS design conventions,” wrote Apple about the award-winning app.

“Next year, we will continue to release additional features and explore international expansion,” says Randall. New features in the offing include margin accounts, support for Mint, broker-to-broker transfers, and more expansion of Android support within other apps. Global expansion plans have kicked off with a $50 million round of funding and an announcement that Australia will be their first overseas market.

So, even with breakneck speed, cutting edge technology and global plans, how do free transactions equal making money? According to Randall, “Robinhood generates revenue by accruing interest off of cash balances and collecting interest on margin (margin accounts will be offered next year). It’s worth noting our cost structure is dramatically lower than our peers — no brick-and-mortar branch locations, no legacy technology, no Super Bowl ads. We’re built from the ground-up using the latest technology which allows us to automate where others can’t.” There is also talk of revenue share with apps that integrate their service.

Photo credit: PinkPersimon via VisualHunt / CC BY