Is BaaS the land of the dead? Actually, not so much. 2024 was admittedly a difficult time for partner banks and fintechs alike when it came to BaaS. But through the fires of consent orders and lost customer deposits came a realization that all firms involved needed to look more deeply into how they structured their relationships.

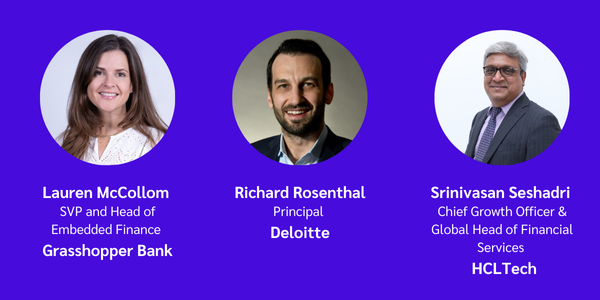

Lauren McCollom, SVP and Head of Embedded Finance at Grasshopper, called 2024 an “enlightening and chaotic year” for BaaS players. As consent order numbers climbed into double digits, hitting institutions like Evolve Bank & Trust, Sutton Bank, and Blue Ridge Bank, many fintechs decided they had to pivot and find new partner banks to ensure their programs’ longevity and survival.

On the other hand, affected partner banks had to dig deep into their existing programs and look for weaknesses, while non-affectees saw more and more fintechs queuing up for partnerships. “This fintech outreach wave which fueled pipelines and enabled partner banks to engage with leading fintechs looking for safety and stability in long-term programs with an established partner bank,” said McCollom.

In today’s story, we look at the major challenges partner banks and fintechs faced in 2024 and what trends may emerge in the new year for these firms.

Recap: 2024’s BaaS trials

Here is a top down view of all the challenges partner banks and fintechs faced last year.

The regulators and BaaS programs: One major difficulty BaaS partners faced was dealing with enforcement actions, reconciliation issues born out of underbaked BaaS programs, and a desire by fintechs to build redundancy in their bank partnerships.

“What came from this period in early 2024 were inquiries and clarification questions from fintechs trying to cut through the noise. Overall this permitted the education of the industry and alignment on what ‘direct’ can mean in BaaS,” McCollom added.

Compliance became top of mind and ultimately led to a reinvigoration of compliance technology providers and a deeper look at how these tools could be used to strengthen existing BaaS partnerships in the face of regulatory scrutiny.

On the other hand, fintechs that foresaw trouble decided they needed a change of partners and sought to migrate their programs leading to a few partner banks seeing more traffic. And while this narrowed the number of partner banks operating in the BaaS landscape, those that continued built much stronger foundations in compliance.

Balancing act: Given the regulatory focus on the industry, firms had to carefully manage building better compliance capabilities while looking after the bottom line. “The balancing act of investing in the necessary infrastructure, controls, and capabilities while maintaining a profitability model added further complexity to the equation,” said Richard Rosenthal, Principal at Deloitte.

The solution to evolving BaaS programs to be resilient to regulatory headwinds for many was putting in place the right infrastructure. There is a class of partner banks and fintechs emerging now that focus on implementing the right controls and processes, added Rosenthal.

Expectations and trends for 2025

_____________________________________________________________________