OTAS Technologies’ Tom Doris is creating machines to do (part of) a trader’s job

Tom Doris is CEO of OTAS Technologies

What’s OTAS all about?

At OTAS we use big data analytics, machine learning and artificial intelligence to extract meaning from market data and provide traders and portfolio managers with insights that would otherwise lay hidden. Our decision support tools help traders to focus on what’s important and interesting, you could say that we use machines to identify the areas that humans should be paying attention to.

I did my Ph.D. in artificial intelligence, and around 2009, it was clear to me that several of the more sophisticated hedge funds were converging on a set of approaches to market data analysis that could be unified and made more efficient and general by applying algorithms from machine learning and artificial intelligence.

Better yet, it quickly became clear that the resulting analysis could be delivered to human traders and portfolio managers using natural language and infographics that made it easy to absorb and action. At the same time, the role of the trader was becoming increasingly important to the investment process, while the problem of executing orders was becoming more difficult due to venue fragmentation, dark pools, and HFT, so it was clear to me that there would be demand for a system that helped the trader overcome these problems.

How does leveraging artificial intelligence for trading help traders and portfolio managers make better decisions and manage risk?

Experienced traders and PMs really do have skill and insight. With all human skills, it is not easy to apply the skill systematically. We can leverage AI to help humans scale their investment process to a larger universe of securities, and also to ensure they apply their best practices on every single trade.

In many professions, everyday tasks are too complex for a human to execute reliably, for instance, pilots and surgeons both rely on extensive checklists. Checklists aren’t sufficient in financial markets because hundreds of factors can potentially influence a trader’s decision, so the problem is to first find the factors that are unusual and interesting to the current situation. This is the task that AI is exceedingly good at, and it’s what OTAS does. Once we’ve identified the important factors for a given situation, machine learning and statistics help to quantify their potential impact to the human, and we use AI to generate a natural language description in plain English.

What is compelling the increased use of artificial intelligence and big data analysis in financial services?

A basic driver is that the volume of data that the markets generate is simply too much for a human to analyze, but the more compelling reason is that AI and machine learning are effective and get the results that people want. Intelligent use of these techniques gives you a real edge in the market, and that goes to the firm’s bottom line.

How do you see artificial intelligence and big data analysis playing a role in trade execution in the future? Any predictions for 2016?

AI is going to provide increased automation on the trading desk. Execution algorithms have already automated the task of executing an order once the strategy has been selected by a trader. Now we’re seeing a big push to automate the strategy selection and routing decision process. The next milestone will be to see these systems in wide deployment, and with it will come a shift in the trader’s role; traders will have more time to focus on the exceptional orders that really benefit from human input. Also, the trader will be able to drive the order book in aggregate according to changes in risk and volatility. Instead of manually modifying each order, you will simply tell the system to be more aggressive, or risk averse, and it will automatically adapt the strategies of the individual orders.

What’s the biggest challenge in acquiring new customers in your space?

Traders have largely been neglected in recent years as regards technology that helps them to make better decisions. Even when the benefits of a new tool are clearly established, it can be difficult for the trading desks to get it through their firm’s budget. Despite the recent hype around HFT and scrutiny of trading, there’s still a lag when it comes to empowering traders with the best information and tools to support them.

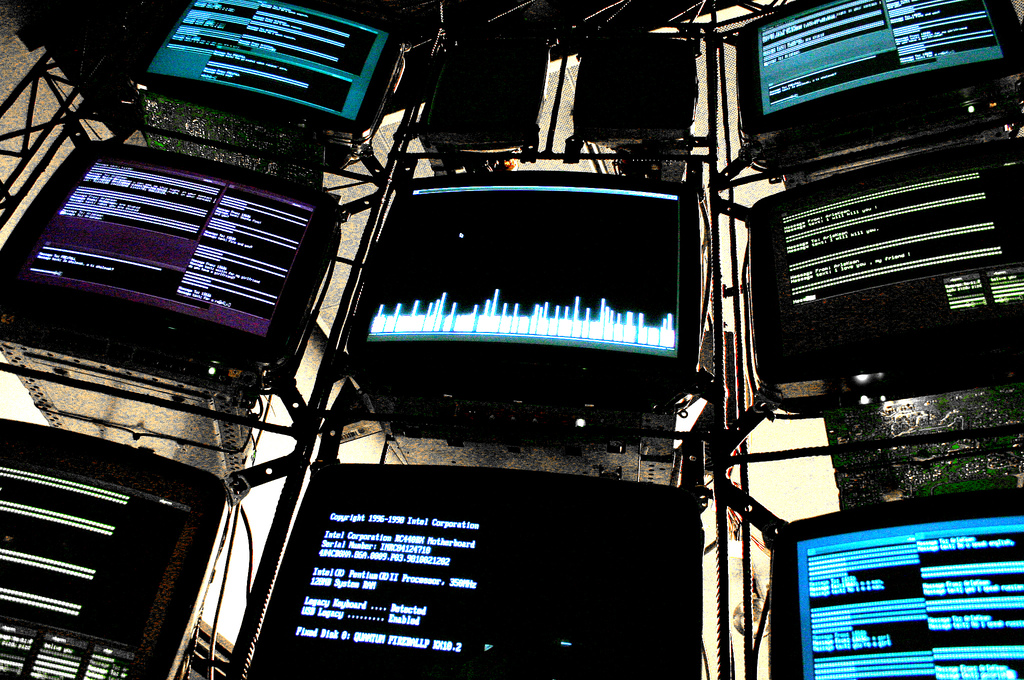

Photo credit: k0a1a.net via VisualHunt.com / CC BY-SA