Startup Tracker’s Jeremiah Smith on how Twitter is a great distribution medium for his complement to CrunchBase

Jeremiah Smith and his Startup Tracker made a big splash on product review site, Product Hunt, recently. Startup Tracker 2.0 had just launched and received over 600 upvotes. Jeremiah joined Tradestreaming to talk about how investors are using the tools he developed to make better investment decisions in startups.

What is Startup Tracker and what was the inspiration behind starting it up? What was the itch you were trying to scratch?

As a founder, one of the crucial things you need to do is keep up with the general trends in the startup world and most importantly in the field your product is in. This means you spend a lot of time looking at, and reading about, what other startups are doing. Whether it’s for competitor analysis, growth strategy ideas or just curiosity, founders usually spend a lot of time keeping track of other people’s startups.

We used to do this by manually googling startups of interest, checking their various online profiles (about page, Crunchbase, Twitter etc. – if they existed) and aggregating the information in spreadsheets. Because the startup world is so dynamic, we had to spend significant amounts of time organizing our knowledge about startups – we even ended up getting an intern to help us, at which point we understood we had to handle this differently.

After failing to find a freely available dedicated solution to track startups, the product guys we are recognized the opportunity to be the first to market in something that was not only going to be very useful for us and fellow founders but also potentially for a wider segment of the startup community.

To test our hypothesis we participated in last year’s TC Disrupt EU hackathon where we won the Evernote prize and got further evidence of interest from actors in the startup community. Although it seems obvious retrospectively, pretty much everybody in the community is tracking startups one way or another. Whether it’s investors prospecting for deals, accelerators selecting candidates or corporate teams looking for partners, acquiring and organizing knowledge about startups is an essential part of people’s workflows. We thus proceeded to make a landing page and a MVP which we launched last December and given the very positive response once again, we proceeded to raise a pre-seed round to launch the proper product.

How are investors using it and how have you improved it since first launching?

Investors, as pretty much everybody else, use Startup Tracker to get a 1-pager about startups they hear or read about and filter out startups that are relevant to them. Startup profiles of interests can be annotated and saved (to Evernote for now).

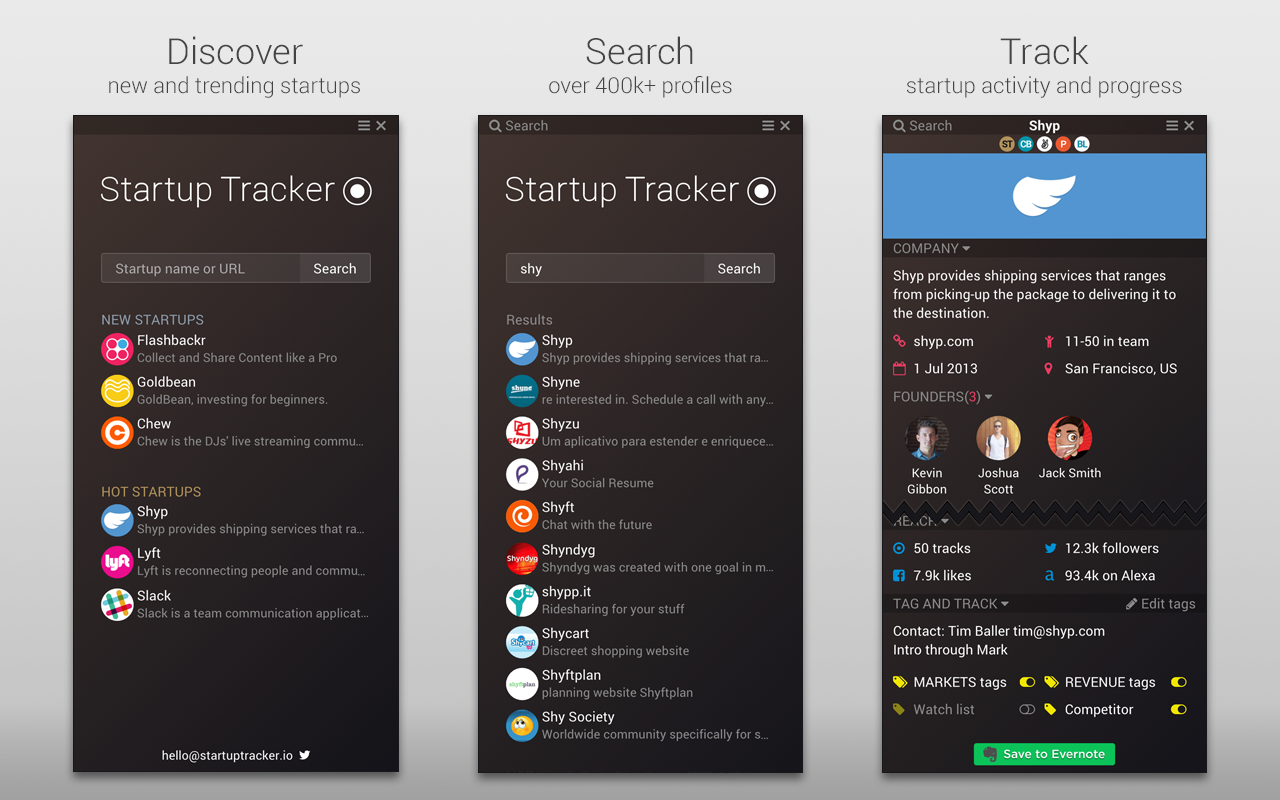

The first Startup Tracker we launched was very much an MVP. For Startup Tracker 2.0 we had to re-implement much of the back and front end to be able to offer it’s defining features:

- A customizable UI to display only the information a user needs

- An information aggregation platform to connect an arbitrary number of data providers to show the must up-to-date information for each startup profile field

- Live-search over all startups profiles; there are currently over 400k profiles across providers

- A crowdsourcing mechanism where users can request specific missing profile fields or entire profile updates from the startups they are interested in

How as the explosion of content and data on startups made it easier/harder to track them? Can you mention your crowdsourcing mechanism — is this a trend to include the crowd in building out the database? How do you ensure data integrity?

I would say the explosion is in the number of startups and their increasingly important role in our societies and economies and not in the actual data about them. Information about startups, specifically early-stage startups, is very much scattered, outdated or altogether inexistant hence the need for services like Startup Tracker.

It’s a hard problem because there is a wide range of potential data one can collect for a given startup and different types of information are more or less difficult to source. For instance, the investing side of the startup community likes to know about startups’ financial details like revenue which startups are not keen on sharing. Conversely, established companies looking for partners in a given niche are more interested in qualitative information such as the market a company is in, what the company does and who the founders are. These are theoretically easier to source as they are part of startups’ public identity but are often times not directly available in practice.

Using crowdsourcing is thus difficult to avoid given the amount and dispersion of information about startups, the question thus becomes: what information do we want to know, and who do we ask it from?

The most well-known startup information database today is CrunchBase. They use a crowdsourcing mechanism where anyone ‘can edit almost everything’ about any startup. This is great because it’s an easy way to source a lot of information. Throughout the years (it was founded in 2007 as a non-profit wiki) they have accumulated around 300k profiles. They also contribute information themselves and have editors which can amend user input (they claim to have had about 80k people contribute to their database in 2014, which also includes people, investments, events and schools). The downside is that data integrity is sometimes at risk. For instance, it has been the case that the website shown on Google’s company profile points to an unrelated promotional site, and auto-contributed information can be incomplete (Here is a good example with Startup Tracker).

We like to think that the approach Startup Tracker takes complements this type of crowdsourcing. We aggregate the existing knowledge over public providers: mainly CrunchBase, AngelList and Product Hunt, and enable users to ask a startup to fill in any missing information on it’s profile by clicking a button. We thus use a 2 legged crowdsourcing mechanism where users tell us the information they are interested in and we try to fetch it for them from the information holders directly. Startup Tracker thus restricts who can contribute to a given profile in exchange for guarantees about the data’s origin (a person who submits information for a startup must tweet us a verification code from the company’s official Twitter handle for us to publish the profile).

We are also developing partnerships to help centralize information from independent sites where one can ’submit their startup’. This way people keep the advantage of submitting their information to a local community while still making their startups easy to search globally. The bottom line is that we believe the best people to ask for data about a startup is the startup itself.

What is going to be the eventual revenue model?

Startup Tracker has two main aspects: gathering startup information and providing tools to work with startup information i.e. annotating, tracking, exporting, reporting etc. Up until now we’ve focused on gathering startup information as it is the prerequisite for data tools to be useful. We have chosen a Freemium revenue model where we will provide some tools for free and others for a monthly subscription fee, keeping a free high quality service for regular users and creating a paid tier for business users. We haven’t decided which of the tools eventually offered by Startup Tracker will be priced, but we have decided access to startup information will remain free.

Can you talk about how to think about distributing tools like ST 2.0? How are you growing your base? What can other apps learn from you?

Natural places to initially distribute startup-related products are Beta List and Product Hunt as they have a startup centric audience. These outlets are easy to reach once you have a solid MVP and are usually enough to reach your first 1000 users who can then help iterate over your MVP. A lot of people also submit their startups to various less known startup directories which in our experience does bring a small but continuous flow of users to your site (there are even businesses built around this including StartupLister and PromoteHour).

Startup Tracker’s current growth engine is based on Twitter. For instance, when we crowdsource a new startup profile it gets tweeted out. Often times the founders, or the startup in question, retweets the news, so that Startup Tracker gets promoted in their social network which probably contain people interested in startups hence potentially in Startup Tracker as well. Much of the process is automated so it scales well.

I don’t think there is a magic recipe in terms of growth, the only reliable pattern we’ve experience is to use communication channels where your target audience is, for the startup crowd Twitter is a good candidate. If you are targeting freelancers, content marketing via blog posts might be a better strategy etc.

Startup Roundup: Marketplace lending up big, blockchain getting a lot of attention

[alert type=white ]Every week, we write about fintech startups raising money, making partnerships, and generally disrupting finance.[/alert]

Wow, what a week.

Money 2020 has turned into a must-attend fintech event. Equity crowdfunding rules were announced on Friday – creating utter chaos for some players and elation for others. Things are speeding up in fintech land as stock market holder ICE bought leading data provider IDC in a deal worth over $5B.

For more fintech coverage during the week, you’re going to want to connect with Tradestreaming on Facebook. Click here to do following Tradestreaming on Facebook.

OneVest Launches “1000 Angels” to Reinvent Venture Capital (Crowdfund Insider)

Tradestreaming Tearsheet: Onevest, a New York based investment crowdfunding platform focused on funding start-up entities, has announced the launching today of its new “1,000 Angels, the “world’s largest digital-first, invitation-only investor network”.

$1 Billion In Small Business Loans From PayPal (PYMNTS.COM)

Tradestreaming Tearsheet: PayPal used to be all about processing payments instead of handling funds, but if you’re not growing in this business, you’re dying. PayPal is serious about growing its SMB loan business and seems to be positioned well to continue attracting new business borrowers.

Can This Startup Restore Privacy in Payments and Turn a Profit? (American Banker)

Tradestreaming Tearsheet: Privacy.com is catching the attention of many finance professionals (including some smart fintech investors) as a creative security platform that’s building its business by protecting transaction privacy. In the Edward Snowden era, it will be interesting to see if the startup can build a business with its revenue model (taking a cut on interchange fees around a transaction).

Bizfi Originates $127M in Financing in Q3 2015 (BusinessWire)

Tradestreaming Tearsheet: Bizfi, a fintech platform that combines aggregation, funding and a participation marketplace for small businesses had a very good quarter, reporting $127M in business financing during Q3 2015.

ReadyForZero launches credit monitoring product (ReadyForZero)

Tradestreaming Tearsheet: Following CreditKarma’s success in providing credit tools, personal finance manager (PFM), ReadyForZero launches its own credit monitoring tool.

Groundfloor Announces Three New Tools to Expand Peer-to-Peer Real Estate Lending (Crowdfund Insider)

Tradestreaming Tearsheet: On Monday during the Money2020 conference, real estate lending marketplace Groundfloor introduced three new analytic tools that allow peer-to-peer real estate investors greater flexibility and analysis over security selection and portfolio management.

Digital Asset Holdings Acquires Blockchain-as-a-Service Innovator, Blockstack.io (Finovate)

Tradestreaming Tearsheet: “Miron Cuperman, Blockstack CTO, called Digital Asset “the best platform” to deliver Blockstack’s blockchain application development tools as part of a comprehensive solution for customers. Digital Asset Holdings CEO Blythe Masters praised both Blockstack’s technology as well as its talent, calling Cuperman “a renowned pioneer in the blockchain world.””

Lending Club Reports Q3 Results. Loan Originations Jump 92% Year-over-Year (Zacks)

Tradestreaming Tearsheet: Lending Club (NYSE: LC), the largest marketplace lending platform in the US, has announced Q3 results. And the origination growth is silencing some of the biggest critics of the first marketplace lender to float on public markets.

Startups raising money this week

Spreedly Raises $2.5 Million in New Funding (Finovate)

Tradestreaming Tearsheet: Spreedly helps marketplaces and platforms accept a wider range of payment types while reducing cost, complexity, and compliance burden.

Zebit Secures $10M investment; Launches Zero-Interest Credit to the Underserved (LetsTalkPayments)

Tradestreaming Tearsheet: The credit can be used to make purchases from the Zebit Market or directly from retailers that accept Zebit as a checkout option.

Issuer processor platform Marqeta closes $25m funding round, new customers (Finextra)

Tradestreaming Tearsheet: At Money20/20 2015, Marqeta, the Open API issuer processor platform, announced a host of new marquee customers, including Affirm, DoorDash, HyperWallet and Kabbage, alongside known customers such as Facebook, Bento for Business and Perk. Marqeta also confirmed closing a $25 million Series C round.

The Ultimate Stock Market Investor’s Guide To Investing In Startups

I published this recently on OurCrowd’s blog and thought Tradestreaming readers would appreciate reading it here, too.

::::::::::::::::::::::::::::::::::::::::::::::::::::

Most investors ‘come of age’ learning the mechanics and strategy of investing through their involvement in stock markets. That makes sense: stock markets are typically comprised of the largest and most stable companies within a geography, with enough interest that investors can relatively easily buy and sell shares. Individual shares and mutual funds populate many long-terms investors’ retirement portfolios. And it’s the stock market, we’ve always been told, that deserves investors’ dollars and attention.

But as new technology enables investing in newer, different types of assets, stock market investors are beginning to look beyond just investing in the stock market and more towards investing in alternative assets: like real estate, commodities, and more often, startups.

But as new technology enables investing in newer, different types of assets, stock market investors are beginning to look beyond just investing in the stock market and more towards investing in alternative assets: like real estate, commodities, and more often, startups.

For the sake of this article, we’re going to focus on investing in small, growth-oriented private companies (startups). Small companies are the lifeblood of the US economy, driving growth and providing new jobs to the workforce. It’s the allure of large, outsized returns by investing in the next Google, Facebook and Apple that is captivating investors right now.

How stock market investors evolve to angel investors

So, how’s a stock market investor to invest in startups? How do stock market investors transition successfully to becoming an angel investors?

While there are shared commonalities between investing in startups and investing in stocks, there are certain nuances that can make the difference between generating market-beating returns or suffering disappointing losses.

Here’s how investors with experience in stock markets should best think about investing in startups:

Diversification

Diversification is a key concept in investing and whether you’re a stock market investor or angel investor, diversification is going to impact your investing results. At a high level, diversification is the only free ride we have as investors: by not putting all our eggs in one basket, we not only lower the risk in our portfolio – we actually improve our performance. This is backed up by some (pretty intense) math as part of the Modern Portfolio Theory.

Diversification is a key concept in investing and whether you’re a stock market investor or angel investor, diversification is going to impact your investing results. At a high level, diversification is the only free ride we have as investors: by not putting all our eggs in one basket, we not only lower the risk in our portfolio – we actually improve our performance. This is backed up by some (pretty intense) math as part of the Modern Portfolio Theory.

For investors putting money into the stock markets, the prevailing rule of thumb is that a properly-diversified portfolio contains 15-20 securities spread across different industries (which perform differently in various economic environments). The idea is that by putting your money into different investments, some will perform well, while others struggle, lowering an investor’s exposure to general market risk and increasing returns in the process. Of course, too much of a good thing can go the opposite way; there is a point where an investor can be over-diversified.

Angel investors also have to deal with risk. But for angel investors, the issue is more acute. If 3 out of 4 startups fail, managing risk becomes paramount for someone investing in startups. As opposed to investing in publicly-traded securities which rarely flop, startups have a much higher attrition rate. Experienced angel investors understand the portfolio dynamics unique to this asset class: typically, a handful of their investments fail, a few have small returns, and just 1 or 2 have such large, out-sized returns that they pay for all the losses (and then some). The data show that to get those sexy returns that headlines boast of (2.5X over 4 years), you’re going to need to invest in at least 10-15 startups. Returns continue to improve with angel portfolios of up to 50 investments. We call this the portfolio approach to investing in startups.

Angel investors also have to deal with risk. But for angel investors, the issue is more acute. If 3 out of 4 startups fail, managing risk becomes paramount for someone investing in startups. As opposed to investing in publicly-traded securities which rarely flop, startups have a much higher attrition rate. Experienced angel investors understand the portfolio dynamics unique to this asset class: typically, a handful of their investments fail, a few have small returns, and just 1 or 2 have such large, out-sized returns that they pay for all the losses (and then some). The data show that to get those sexy returns that headlines boast of (2.5X over 4 years), you’re going to need to invest in at least 10-15 startups. Returns continue to improve with angel portfolios of up to 50 investments. We call this the portfolio approach to investing in startups.

Follow-on rounds

Investors in the stock market have learned that one of the best ways to increase their returns over the long term is to consistently reinvest their dividends. That means, any cash that’s generated from an investment should get ploughed back into the company, increasing ownership over time by taking advantage of any fluctuations in stock prices. The research proves that dividend reinvestment really works to build wealth: From 1988 to July 2013, $10,000 invested in the S&P 500 would have grown to $68,200. But reinvesting dividends would have almost doubled that return, jumping to $120,600. That’s improving returns 2X as much by merely reinvesting.

The story is a bit different with startup investing. Just because you find a hot tech company in which to invest $10,000 doesn’t mean you’re done tapping into your wallet. Startups typically need to raise more money in the future (called follow-on rounds). Early investors typically get the opportunity to re-invest in their portfolio companies along the way to exit. Meaning, when companies need to raise future rounds of capital, you should have the opportunity to invest again (hopefully, if things are going right, at a higher valuation). If you don’t exercise your right to reinvest, you run the risk of getting massively diluted as your portfolio companies raise larger rounds in the future.

To invest profitably in startups, it’s important to understand the entire lifecycle of an investment in a startup. Take a look at the following Slideshare we created to address the entire lifecycle of startup investing:

An angel investor sits in a good position: you get to invest early, while later on gaining access to ensure your equity stake doesn’t get diluted as valuations go up. As 500Startups’ famed investor, Dave McClure, counsels angel investors simply: Invest in a company BEFORE it achieves product/market fit and then double-down AFTER through follow-on rounds. As an angel investor, definitely keep some money as dry powder to continue to invest in the best-performing companies in your portfolio as they conduct follow-on rounds of funding.

Liquidity constraints

Most of the time, in a major market, stock market investors don’t think too much about liquidity. If you’re buying Apple ($AAPL) or Google ($GOOG) stock, you click a button, and boom! The stock automatically appears in your portfolio. The transaction is nearly instantaneous and the price an investor pays is pretty much the price the seller of the stock receives. The same dynamic mostly holds true whether you’re buying a large cap stock, exchange-traded fund or mutual fund (which price at the end of every day). Liquidity is not a thought that most stock market investors are concerned with while transacting in common instruments.

Most of the time, in a major market, stock market investors don’t think too much about liquidity. If you’re buying Apple ($AAPL) or Google ($GOOG) stock, you click a button, and boom! The stock automatically appears in your portfolio. The transaction is nearly instantaneous and the price an investor pays is pretty much the price the seller of the stock receives. The same dynamic mostly holds true whether you’re buying a large cap stock, exchange-traded fund or mutual fund (which price at the end of every day). Liquidity is not a thought that most stock market investors are concerned with while transacting in common instruments.

That’s definitely not the case if you’re transacting in a small-cap company with little daily trading volume. The Bid and Ask price — basically, the price the buyer is willing to pay for a stock and the price at which a seller is willing to sell — can be significantly different. More than that, a single investor transacting in an illiquid stock can severely impact the price level by trying to buy or sell just a small amount of stock. This lack of liquidity has to be taken into account when making an investment in an illiquid investment or while considering when to exit one.

Private companies, like startups, can be one of the most illiquid types of investments an investor makes. There isn’t really a market for shares in small startups and that means when an angel investor makes an initial investment, his or her holding period really is forever. Even purchases are a bit more complicated than just clicking a button — there is more paperwork and contractual agreements that go into investing in a private company. And unless that company gets bought, IPOs, or goes bust, the investor is most likely going to hold the investment forever. So, David Cummings’ advice is sound:

“The next time you think about making an angel investment, remember the lack of liquidity challenge and make sure that the money isn’t needed for a long, long period of time.”

Time frame

Stock market investors have been trained to think about their portfolio and investment activities associated with time frames. The return profiles of different asset classes differ and what’s more, because of risk associated with some investments, the suggested time frame for each asset class diverges (professionals generally caution investors to hold riskier investments for longer time frames to get exposure to the real returns of the asset class).

It’s when we look at long term returns, we generally see a connection between liquidity and investor holding periods. For stock market investors, we’re used to discussing investment horizons over the short term (1-5 years), medium term (5-10 years) and long term (over 10 years). That said, the prevailing sentiment in the stock market is overwhelmingly short-term focused. That’s why we have 24/7 cable networks focused on the minutae of every market gyration. It’s a rare investor nowadays who mimics the Oracle of Omaha, Warren Buffett, who once claimed thathis favorite holding period was forever.

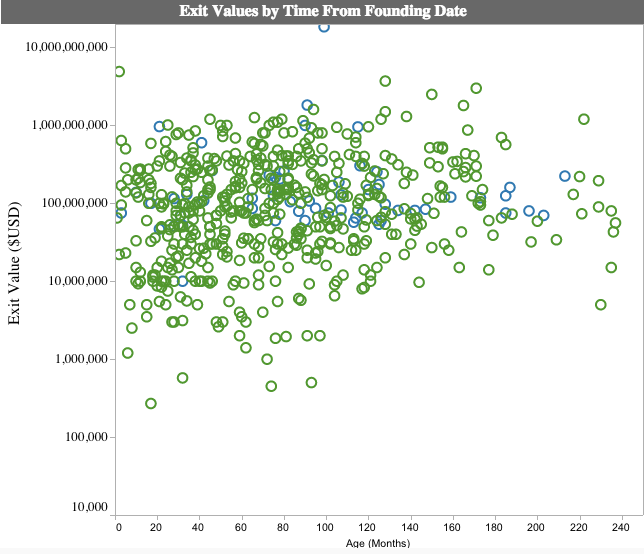

Liquidity and holding periods impact angel investing as well. Because there isn’t liquidity, investors have to be comfortable holding on to a startup investment until there’s an exit (IPO or M&A) or a failure. Companies that get acquired are typically 7 years old.

There’s something else at play when you look at the holding period for private investments. For professional venture capitalists, limited partner agreements are structured over 10 years, of which they spend the first 4 years deploying a hefty percentage of that capital. This 10-year structure means there are some interesting dynamics that impact both companies pitching VCs as well as the limited partners investing in VCs. If you look at individual angel investors, they’re not really in the business of raising funds and deploying them and rinsing/repeating. Angels are attached at the hip to their investments and it can take multiple years before angels reap the full returns on their successful companies.

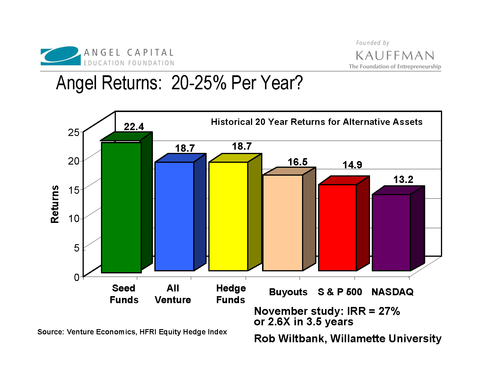

Long term returns

The long term success of the stock markets has been touted for years as a reason for people to park their retirement funds in the market. While we’re used to talking about the stock market’s long term returns as ranging between 11-13% (which doesn’t account for inflation), this focus misses the point: that many of the moving parts that make up the markets have seen really different returns over the long term. For example, small cap stocks typically see more volatility and over the long term are expected to perform better than larger companies that are more stable and have less steep growth trajectories. Domestic U.S. stocks perform differently over time than do foreign stocks. The point here is that in a diversified portfolio, investors gain from the fact that different asset classes perform differently, lowering volatility and improving returns over the long run.

When you look at startups, performance is interesting. On the one hand, if you look at the chances that an individual investment will be a successful, it’s pretty bleak. In any ONE investment, an angel is more likely than not to lose their money. But, here’s where portfolio management comes in: by having a diversified portfolio of multiple startup investments (10-15), angel investors average a 2.5X return over 4 years(source).

So, while investors should diligence each opportunity as though it’s the only investment their making, the real returns come from having a long term, diversified portfolio.

Ability to add value

Stock market investing is pretty passive. Outside of hyperactive day traders, real investing is a dispassionate activity and shouldn’t actually take that long to determine what to invest in. Once a portfolio is built, prevailing wisdom is to periodically rebalance (quarterly or yearly). Other than that, there isn’t much more for a stock market investor to do to better his or her performance.

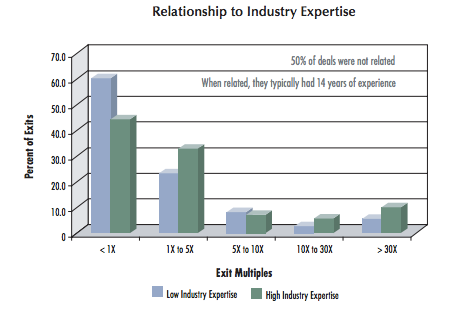

That definitely isn’t the case for angel investors. Startup investing is probably the only type of investing where investors have the opportunity to provide real value to their portfolio companies. Angel investors bring their rolodexes and their real-world experience to the private investments they make. It’s not only a common practice for early stage investors to assist their companies, the data show that it’s a profitable activity. The Kauffman Foundation’s research on angel investing shows that investor expertise has a material impact on earned returns. In fact, investment multiples were twice as high for investments in ventures connected to investors’ industry expertise.

That definitely isn’t the case for angel investors. Startup investing is probably the only type of investing where investors have the opportunity to provide real value to their portfolio companies. Angel investors bring their rolodexes and their real-world experience to the private investments they make. It’s not only a common practice for early stage investors to assist their companies, the data show that it’s a profitable activity. The Kauffman Foundation’s research on angel investing shows that investor expertise has a material impact on earned returns. In fact, investment multiples were twice as high for investments in ventures connected to investors’ industry expertise.

The need for quality deal flow

As a stock market investor, you can just boot up your computer, log in to your brokerage, and invest in pretty-much anything you want. There’s no centralized market for investing in startups (at least not yet — companies like OurCrowd and AngelList are helping to make this happen). To become a good angel investor, you’re going to need to get access to high quality deal flow. We wrote recently onhow top angel investors improve the quality of the deals they’re seeing. The more high quality investment opportunities that come across your desk, the better your chances of making the 2.5X return over 4 years, as the data show.

One clear way stock market investors can get quality deal flow is by signing up to equity crowdfunding platforms like the kind we’ve built at OurCrowd. We see over 100 deals in top startups from around the world – every month. Our diligence team stretches, pokes, and turns these opportunities inside-out until we find just a handful of investable startups that pass our investment criteria checklist. We provide access to accredited investors of all kinds (including investors with experience investing in the stock market) who want to choose their own investments from among a professionally-curated group of early stage investment opportunities.

One clear way stock market investors can get quality deal flow is by signing up to equity crowdfunding platforms like the kind we’ve built at OurCrowd. We see over 100 deals in top startups from around the world – every month. Our diligence team stretches, pokes, and turns these opportunities inside-out until we find just a handful of investable startups that pass our investment criteria checklist. We provide access to accredited investors of all kinds (including investors with experience investing in the stock market) who want to choose their own investments from among a professionally-curated group of early stage investment opportunities.

Making the change: Becoming an angel investor

Investing in startups can be extremely lucrative…if you know what you’re doing. Stock market investors may have a wealth of knowledge behind them about what makes for sound investing practice. The differences in stock market investing and angel investing are manageable enough that the transition should be smooth. Angel investing is learnable; there are plenty of entrepreneurs who built startups themselves, who have made the transition to investing in startups and are making a lot of money. To do it right, understand the differences to leverage your investing experience to apply it to this new asset class of private, startup companies

004 Crowdability and educating investors on the crowdfunding opportunity

On this week’s TWiC podcast, we interview the guys behind Crowdability — a great resource for investors thinking about getting a bit more serious about equity crowdfunding. Matt and Wayne are 2 extraordinary entrepreneurs in their own right and have a bold vision of providing an educational and decision-layer to help investors make better decisions when investing in startups online via equity crowdfunding.

In this week’s news roundup, David and Zack look at the differences between raising money via crowdfunding or turning to more traditional sources of capital. BitTorrent is using its massive network of 170 million users to crowdfunding new forms of content. Lastly, is beer the most perfect of crowdfunding projects? David thinks it just may be…

We review CrowdBrewed, a crowdfunding site that encourages (you guessed it), funding of beer-related enterprises.

Listen to the FULL episode

Resources mentioned in the podcast

- Crowdability

- Crowdfunding vs. VC Seed Rounds: Which makes sense? (BetaBoston)

- CrowdBrewed

- BitTorrent to tray a paywall and crowdfunding (NYT)

- Beer: The Best Use of Crowdfunding or The Most Best Use of Crowdfunding?(TechCrunch)

Recommended resources for investing in startups from Crowdability

- Fred Wilson’s blog

- Hunter Walk’s blog

- Marc Andreesen’s blog

- David Rose’s book: Angel Investing: The Gust Guide to Making Money and Having Fun Investing in Startups (Amazon)

- CB Insights newsletter

- Mattermark newsletter

- Strictly VC

**You can now listen to TWiC on iTunes (nice!). If you’re listening to our podcast and enjoying it, finding some value, or just using it to stay on top of everything crowdfunding, please give us a good rating on iTunes. We’ll mention you on the show with a shout-out. We’re really appreciative of your feedback and continued listening — we’re all in this together and your support helps keep our show fresh and growing.