How AI is changing payment fraud prevention: From evolving scams to predictive defenses

- Fraudsters are leveraging AI to refine their attacks, leaving organizations facing mounting financial hits.

- Firms are losing an average of $60 million annually to payment fraud, according to a Mastercard commissioned new research from Financial Times Longitude. But the same technologies behind the problem can also unlock the solution.

Fraudsters are using AI to launch more sophisticated, targeted attacks, resulting in financial losses for organizations everywhere.

Mastercard recently commissioned new research from Financial Times Longitude, surveying 300 senior fraud and risk executives across the globe. The report found that leaders are battling rising fraud, and on average, their firms are losing $60 million in annual revenue to payment fraud. Yet the very tech behind the threat also holds the cure.

AI is already saving millions – if deployed well

The report shows financial institutions are increasingly turning to AI to bolster their defenses. And the data is encouraging: deployed effectively, AI is helping organizations claw back millions in revenue and stay a step ahead of fraudsters.

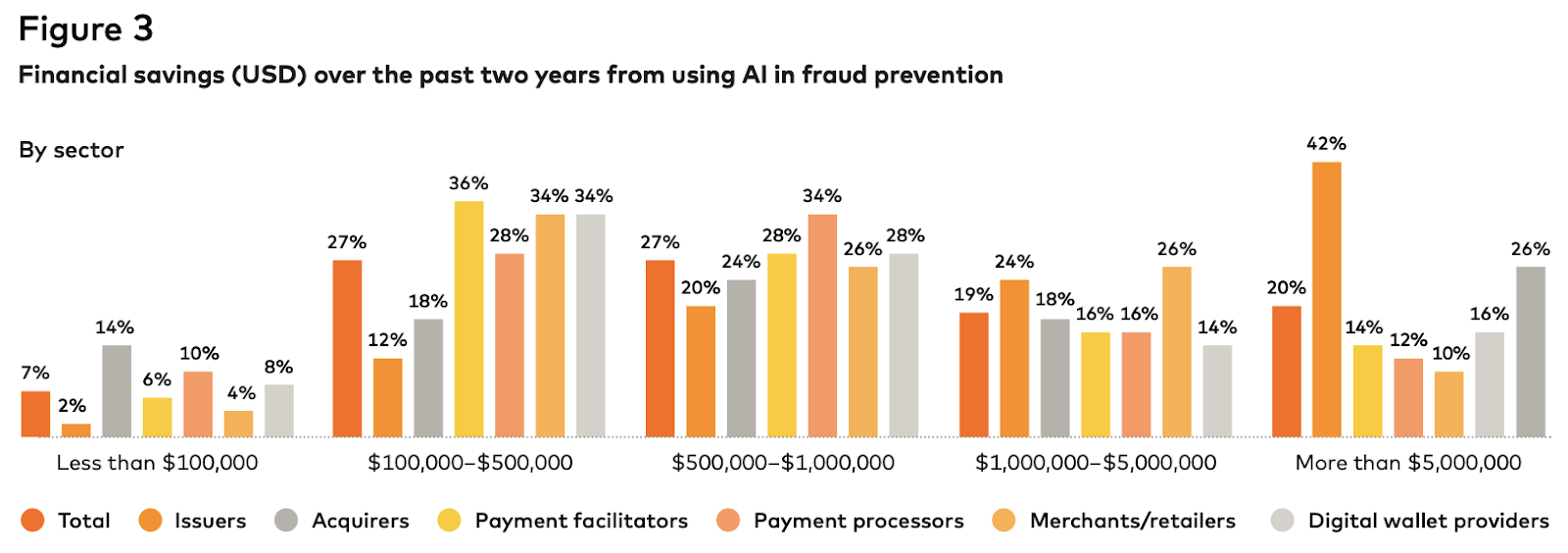

42% of issuers and 26% of acquirers report saving more than $5 million over the past two years by using AI in fraud prevention.

Issuers, who sit closest to the transaction authorization moment, see the strongest upside from AI in reducing false positives and sharpening fraud detection. Acquirers are catching up with these gains but often contend with more fragmented data sources. For merchants and wallet providers, savings from AI are harder to prove out, often because losses are smaller in absolute terms or because reimbursement shifts the cost burden upstream.

ROI from AI is tangible, but the impact varies. Firms that integrate data deeply into decisioning workflows are likely to see quicker benefits.

The AI defense strategies in play: anomaly detection leads the pack

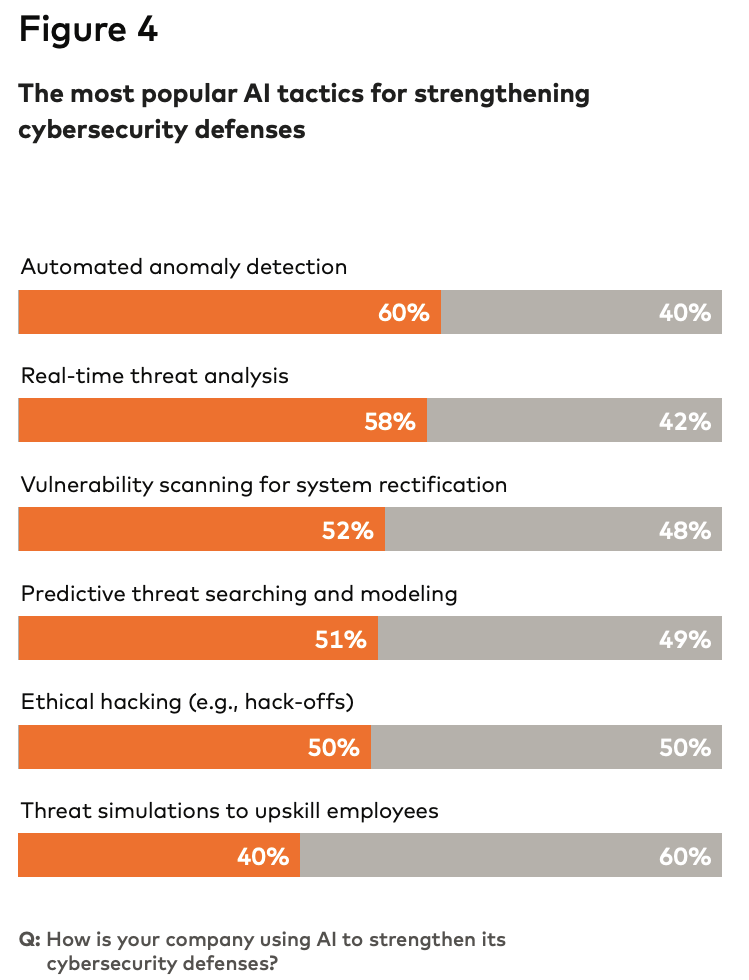

Firms are turning to AI to sift through vast transaction volumes, identify anomalies, and stress-test systems against fraud.

Anomaly detection is AI’s most effective line of defense in fraud prevention, used by 60% of executives and their organizations, with real-time threat analysis close behind at 58%. More than half also put their trust in AI for vulnerability scanning (52%), predictive modeling (51%), and ethical hacking (50%).

Those adopting a mix of proactive tactics, like simulations and predictive modeling, and reactive ones, like real-time blocking, are creating a more layered defense.

Still, adoption isn’t uniform. Smaller firms may lack staff to run simulations or red teaming exercises, leaving them dependent on vendor tools. Larger players, by contrast, can operationalize AI across fraud, cyber, and compliance simultaneously.

The threats on the horizon

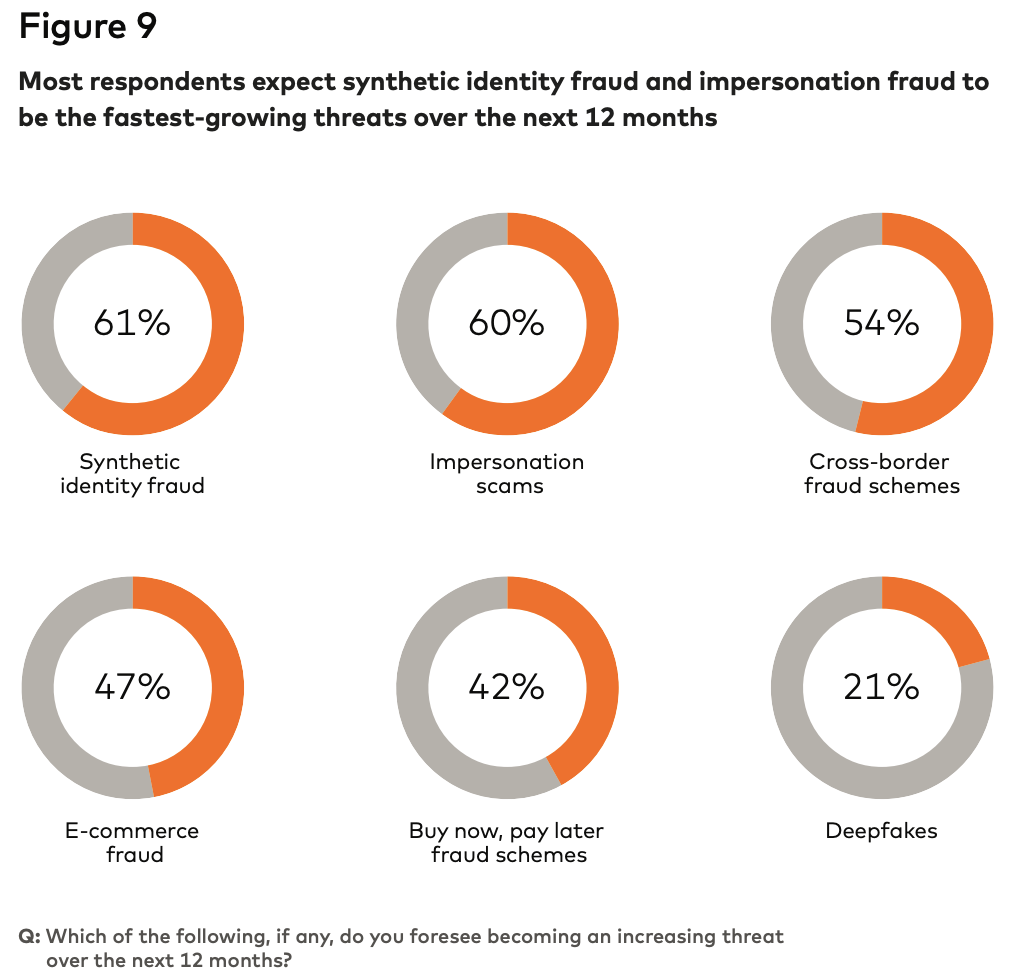

Strengthening defenses can also lead to new challenges, as fraudsters adapt to these changes. Executives expect the next wave of threats to emerge soon.

Synthetic identity fraud (61%) and impersonation scams (60%) are expected to rise the most in the coming year. Cross-border fraud (54%) and e-commerce fraud (47%) follow close behind.

Synthetic ID fraud is especially worrying; it blends real and fabricated credentials into believable personas, allowing fraudsters to open accounts and build credit histories that withstand shallow checks. Impersonation scams, boosted by affordable and easily accessible gen AI voice and video tools, are turning routine customer interactions into traps. And cross-border schemes highlight the complexities of global payment systems and regulations that fraudsters often exploit.

The forecast is less about new forms of fraud and more about fraudsters upgrading their toolkits faster than some payment systems can adapt. It’s a moving target that puts a premium on fresh data and collaboration across institutions.

Shared intelligence is the hidden multiplier in fighting fraud

Fraud isn’t a single-company problem; it’s a system-wide challenge that requires a system-wide response. One company’s blind spot can be another’s red flag, which is why building alliances and sharing intelligence can be a differentiator in combating fraud.

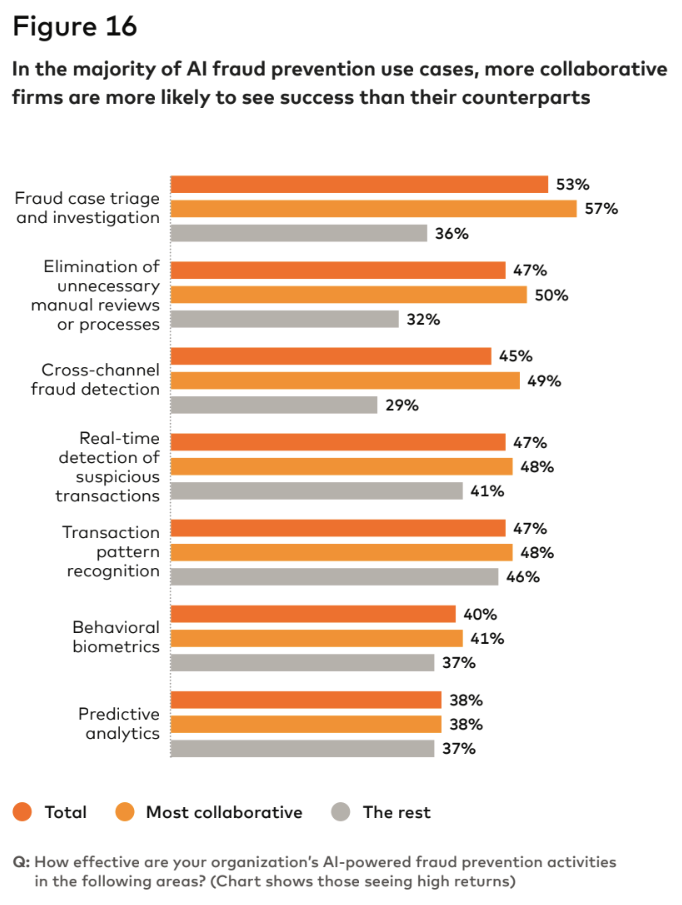

Companies that cast a wider collaborative net see better returns from their AI investments. Among the most collaborative firms, 57% report strong returns from AI-driven fraud case triage, compared with 36% of those working less collaboratively.

Fraudsters cross industry lines with ease, shifting from banks to retailers to wallets to processors in search of weak spots. A phishing kit tested on one set of victims today can be redeployed against another tomorrow. Alone, each company sees only fragments of the threat. Together, those fragments form a clearer picture, a warning system that turns scattered incidents into evidence of a coordinated attack.

With collaboration at the center and AI as an enabler, organizations can create defenses that evolve as quickly as the payment fraud risks they face.

To stay ahead of fraud and maximize the ROI of AI investments, download Mastercard’s report, On the right side of AI: Shaping the future of payment fraud prevention.