Crypto 2024 outlook in the wake of ETF approval: The intersection of politics, rate cuts, and emerging regulation

- A rising wave of young investors is embracing crypto as a strategic shield against inflationary pressures.

- Analysts and industry experts harbor an optimistic outlook for crypto stocks and investment products amid the buildup to the approval of ETFs and anticipated rate cuts by the Fed that reverberated across the crypto market.

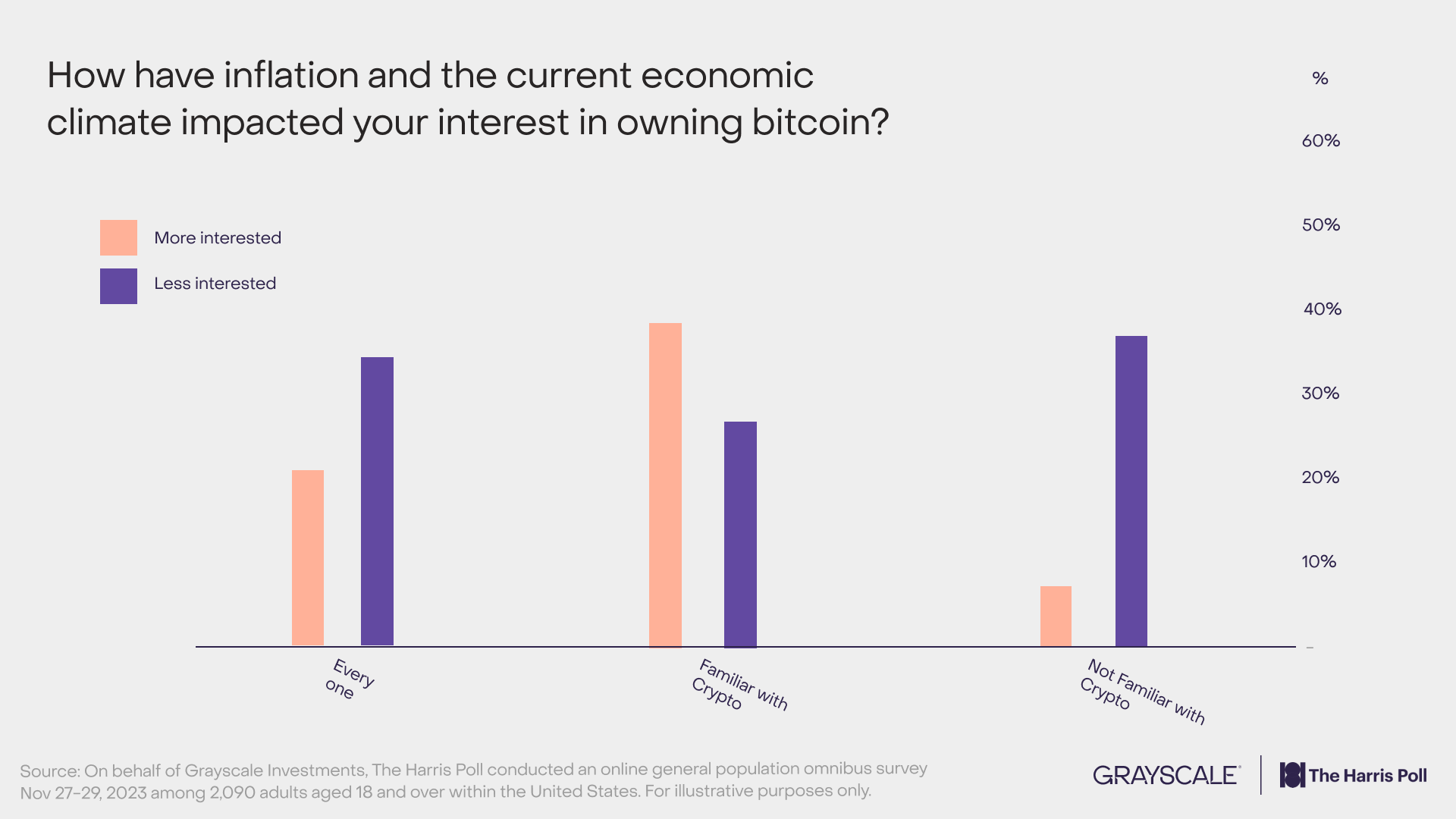

Amid the buildup to the approval of crypto ETFs and concerns about financial stability and inflation, many young individuals are turning to crypto investments, viewing them as a bulwark against inflationary pressures in the long term, according to a new survey by Grayscale.

The research also highlights that consumers with a comprehensive understanding of cryptocurrency tend to be more inclined toward crypto asset investments.

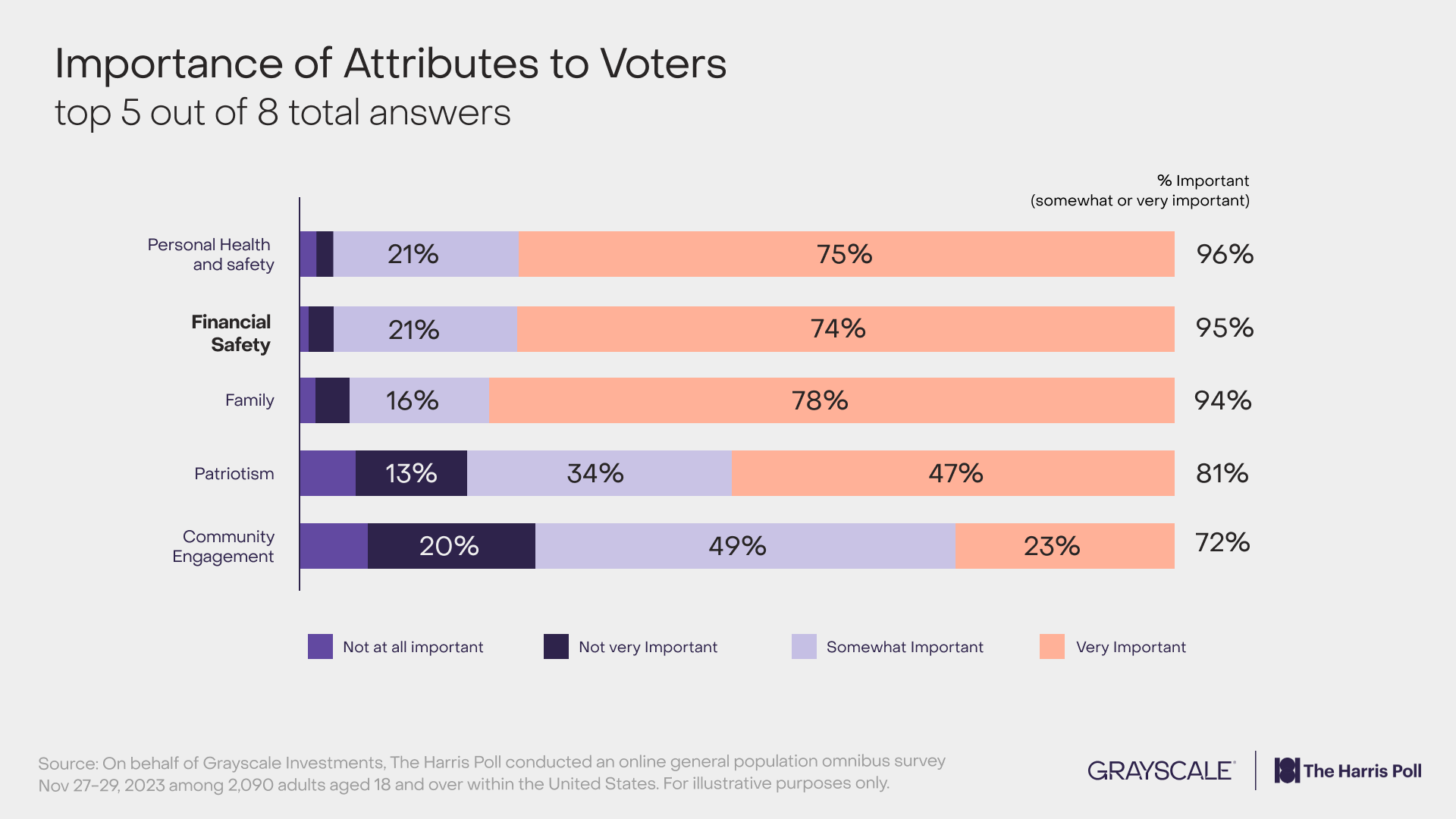

This growing interest in digital assets is also influencing consumers’ preferences to an extent where it plays a significant role in their consideration of new leaders vying for a position in the upcoming presidential election.

Half of the young voters — Gen Z and Millennials who own more crypto than equities – aim to choose candidates knowledgeable about and supportive of the cryptocurrency industry. According to the report, this prerequisite takes center stage in part due to the younger generation’s belief in the interconnected future of finance, cryptocurrency, and blockchain technology. In addition, they envision this convergence as a pathway toward a financial system outside the traditional structure that can provide a more financially resilient environment for consumers at large.

While some continue to see Bitcoin’s scarcity as a hedge against inflation, others label it a marketing gimmick. The former assumption is still unverified, especially in light of last year’s crypto market contraction following the collapse of FTX and other major players that further prompted regulatory actions on the resilience of crypto investments.