Blockchain and Crypto, Member Exclusive

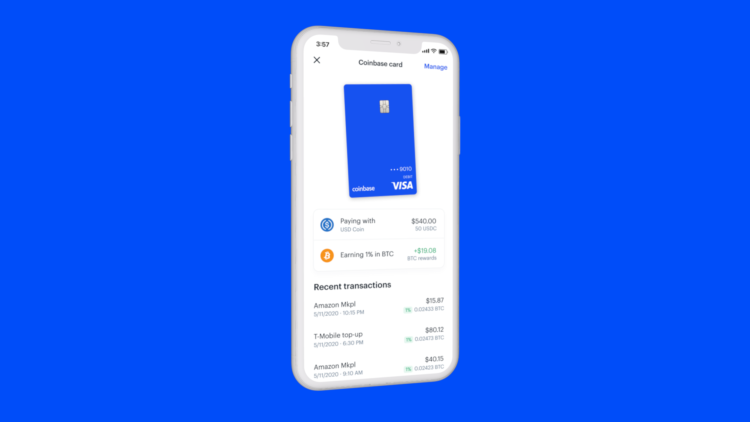

Building the primary financial account of the cryptoeconomy, Coinbase launches a debit card

- For crypto to become more mainstream, the set of technologies needs to become easier to use.

- Coinbase is launching a debit card that lets users spend crypto just by swiping.