How to turn AI ambition into business results

- AI is everywhere — but it’s not a shortcut to success. As organizations race to embed it across operations, it’s clear that ambition alone won’t deliver impact.

- Organizations must establish a framework that harmonizes risk management and innovation through aligned objectives, measurements, and execution strategies.

AI’s potential is undeniable — but for many organizations, the path from ambition to impact is riddled with risk. Forty-seven percent of executives say AI has not met their expectations.

To change that, firms need a clear framework that balances risk and innovation from day one by aligning goals, measurement, and execution.

In this article, we break down key steps of the De-risking innovation in the age of accelerated AI guide so that organizations can turn bold moves into smart bets.

Set goals that match your risk appetite

Before launching an AI initiative, organizations must first calibrate their ambition to their risk appetite. Mastercard’s framework outlines three strategic orientations – to keep pace, differentiate or trailblaze – each with a distinct risk profile and expected returns:

- Keep pace: These initiatives focus on matching competitor performance and capabilities. They carry the lowest risk and typically yield incremental gains in efficiency and productivity. The goal is operational parity — ensuring the organization doesn’t fall behind.

- Differentiate: Projects in this category aim to outperform peers by enhancing the customer experience, streamlining workflows, or optimizing pricing. They involve moderate risk and offer measurable improvements in reach, profitability, and brand distinction.

- Trailblaze: These are bold initiatives with greater risk that are designed to reshape market dynamics. They often involve new business models or technologies — such as embedded finance or AI-driven product design — and require a greater tolerance for uncertainty but can yield outsized returns.

By identifying where an initiative sits on this spectrum, organizations can better align their strategy, resources, and expectations.

Focus on measurement

Half of organizations lack metrics that track the business outcomes of their AI initiatives. As a result, without clear measurement, they’re flying blind — unable to assess progress, pivot when needed, or prove value.

One effective framework evaluates whether AI initiatives are making the organization smarter, more personal, and more secure:

- Smarter: AI’s data analysis capabilities enable organizations to examine internal and market trends, boosting operational efficiency. Organizations should assess whether AI initiatives improve understanding of operations, customers, and market dynamics effectively.

- More personal: AI can also help retailers and FIs build more personalization into their digital footprint and customer experience (CX). Organizations should monitor what improvement AI initiatives introduce in tailoring experiences to customers’ needs.

- More secure: AI and machine learning are becoming essential tools for businesses seeking to detect and eliminate fraud. Businesses should pay attention to how their AI initiatives are improving their security posture by measuring increases in trust, safety, and resilience.

Empower deployment

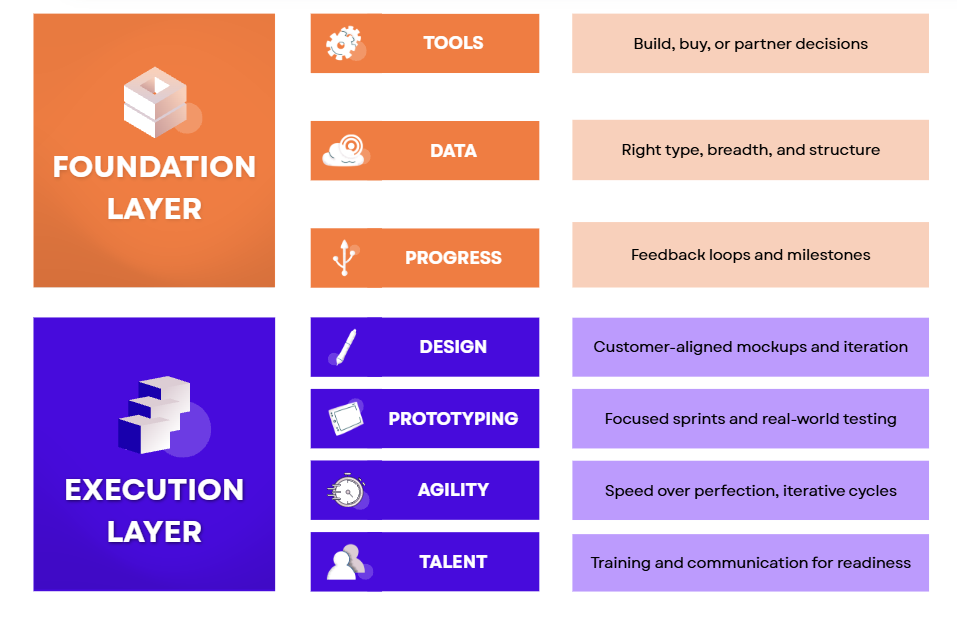

Even with clear goals and strong measurement, AI initiatives can falter without a deliberate approach to deployment. Mastercard’s framework breaks implementation into two distinct phases: a foundation layer and an execution layer:

Foundation layer

This phase focuses on establishing the infrastructure needed to support successful AI initiatives.

- Tools: Organizations must decide whether to build, buy, or partner. The right choice balances internal capabilities with speed and cost.

- Data: AI is only as good as the data it runs on. Organizations should ensure they have the right type, breadth, and structure of data to support their goals.

- Progress: Integrating feedback loops and trackable milestones helps teams demonstrate early value and stay aligned with business outcomes.

Execution layer

This phase moves ideas from concept to reality, emphasizing agility and alignment.

- Design: Strong infrastructure only goes so far if the experience doesn’t reflect what customers need. It helps to align mockups early and create space for iteration before development begins.

- Prototyping: Prototyping tends to work best when broken into focused sprints with clear goals. Testing in real-world scenarios can surface valuable insights early on.

- Agility: To scale, businesses need agile development cycles, with focused sprints and clear goals. These cycles prioritize speed over perfection and iterate based on real feedback.

- Talent: Even the best tools need the right people and support to succeed. Building readiness through communication and role-based training can help teams feel confident and engaged.

As Bola Asiru, Global Vice President of Digital Consulting Products at Mastercard, puts it:

“Rapid prototyping and agile development aren’t just buzzwords — they’re how we de-risk innovation. The faster we pilot and pivot, the faster we deliver what actually works.”

Turn AI ambition into strategic action

AI’s potential is immense — but ambition alone won’t be enough. To deliver real impact, organizations must calibrate their goals to risk, embed meaningful measurement, and empower teams to deploy with agility and intent. Download the full Mastercard guide to learn how to turn bold ideas into smart bets.