How to run a BaaS relationship, a guide for fintechs and banks

- The biggest problem in the current intermediary-reliant BaaS set up is that it makes it very hard to isolate who is responsible for what, and in so doing, complicates risk mitigation strategies.

- These relationships have now come home to roost and are forcing sponsor banks as well as fintechs to build partnerships that are clearer and more stable from the outset.

2024 has been a really tough year for BaaS players, and it’s reorganizing how the industry has structured itself over the years. Thanks to an increased amount of regulatory activity, as well as some very public instances of BaaS relationships failing and putting customers’ funds at risk, the bank-fintech partnership landscape has gotten a lot more complicated than it was just a handful of years ago.

The biggest problem in the current intermediary-reliant BaaS set up is that it makes it very hard to isolate who is responsible for what, and in so doing, complicates risk mitigation strategies.

“When you look at partner banks, the risk relationship kind of breaks down,” said Konrad Alt, co-founder of Klaros Group, which advises banks and fintechs on compliance and risk.

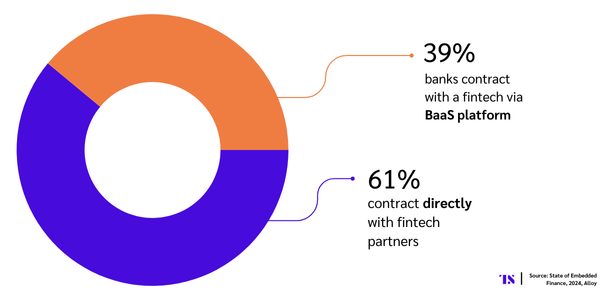

These relationships have now come home to roost and are forcing sponsor banks as well as fintechs to build partnerships that are clearer and more stable from the outset. 61% of banks are now contracting fintechs directly, according to new data.

“The banking industry wasn’t ready to have that direct relationship yet,” says Sara Seguin, Fraud and Identity Advisor at Alloy on why this shift away from BaaS intermediaries is happening right now.

Seguin, who also has experience working at KeyBank as its Head of Enterprise Fraud Strategy & Business Intelligence, has a unique insight into the troubles and obstacles banks face when partnering for BaaS.

The trials of partnership _______________________________________________________________