CFPB’s proposal to cut overdraft fees may suffer from problems of intentions and structure

- In order to curb possible exploitation through overdraft fees, the CFPB is attempting to close a regulatory loophole that may allow banks to profit unfairly from overdrafts.

- There are two main contentions with the Bureau’s proposal: one is more about intentionality while the other is focused on its structure.

As part of its efforts to lower costs for American families, the Biden administration, with the help of the CFPB, wants to cut down on excessive overdraft fees.

“For too long, some banks have charged exorbitant overdraft fees – sometimes $30 or more – that often hit the most vulnerable Americans the hardest, all while banks pad their bottom lines. Banks call it a service – I call it exploitation. Today’s proposal would cut the average overdraft fee by more than half, saving the typical American family that pays these fees $150 a year,” said President Biden in his statement on the CFPB’s proposed rule released on January 17th.

Context: The current proposed rule on overdraft fees is part of the Bureau’s efforts to reduce junk fees. To do this, the Bureau collected public comments from 80,000 consumers. Overdraft fees surfaced as a common grievance.

Initially, overdrafts were introduced out of consideration for the consumer and allowed the processing of transactions even if the consumer did not have sufficient funds, by levying a relatively low fee.

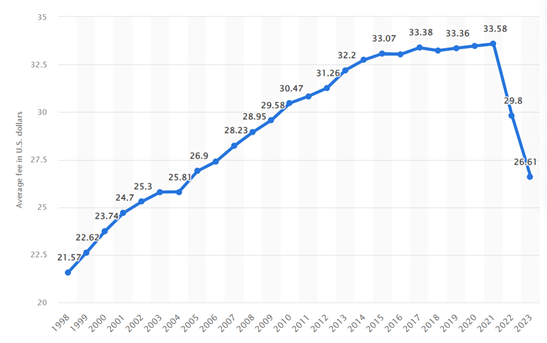

Fees have risen dramatically over the years and some even say that they drive low-income Americans away from the banking system and towards less regulated and more risky alternatives like payday loans.

In order to curb possible exploitation through overdraft fees, the CFPB is attempting to close a regulatory loophole that may allow banks to profit unfairly from overdrafts. The Truth in Lending Act (1968) requires banks to furnish the consumer with disclosures about their loans as well as associated fees. But an exemption by the Federal Reserve Board allows banks to not treat overdrafts as a lending product, thereby circumventing any need for disclosures.

CFPB’s aim: Now the CFPB wants to do away with this exemption and require FIs with over $10 billion in assets to treat overdrafts as a lending product which would necessitate disclosures. The Bureau also wants to set limits on the fee amount, stating that firms need to establish a fee that allows them to break even. Or they could structure the fees according to the benchmarks set by the Bureau of $3, $6, $7, or $14, which are considerably lower than the average of $26.6 today.

Points of contention

There are two main contentions with the Bureau’s proposal: one is more about intentionality while the other is focused on its structure.