Banks have generally steered clear of influencer marketing even as some fintechs like Current and Chime have used it to connect more widely to their audiences. And this reluctance to use creators in their marketing is also emblematic of how little traditional FIs understand about this sector. This lack of understanding also seeps into capturing the creator economy as customers and results in financial products that focus on making creators’ lives easier, being few and far in between. It’s a missed opportunity to connect to a customer base that is grossly underserved, growing rapidly – especially due to the low barrier to entry–, and strongly financially motivated. 78% of people report that being a creator helps them establish financial stability, according to research. And there are loads of issues that a so-inclined FI could potentially solve. Like any other SMB, creators need tools that help run their businesses, as well as ease the process of getting paid. While most big banks now have a healthy suite of products directed at SMBs, the nuances of the creator economy like unpredictability of payment and diversified income streams, warrant a dedicated strategy.

Why FIs have been reticent

It won’t be wrong to say that what makes creators different from normal SMBs is also what makes them harder to build products for.

Influencers don’t fit existing molds: “Traditional banks are not engaged in building products for creators due to the instability of creators’ income streams. Banking business models are generally built around servicing “stable” customers, such as salaried employees or established businesses. They may view creators as higher-risk clients because it is difficult to apply traditional financial models like credit scoring, lending, and financial planning to them,” said Tachat Igityan, CFO and Founder of destream, a financial platform for content creators.

They have varying needs: Veteran Youtuber Hank Green, author and founder of Subbable, a crowd sourcing platform that was sold to Patreon, has expressed how hard it is to build products for this segment, having considered to build one himself during the years when VC funding was at its highest:

“Creators are so diverse in their needs that, to create a product that is scalable — and that doesn’t cost a ton of money trying to individualize itself for each individual creator — you end up creating a bad product,” said Green. Powerful platforms: Apart from the diversity inherent to this segment, building products for influencers is made more complicated by the power social media platforms hold in the lives of content creators. Even for Youtubers as skilled, famous, and experienced as Green, the exact amount of money they make on a particular platform can sometimes be unclear. “It’d be nice if I knew how much money I made. I have no idea, it hasn’t updated since January. It’s broken. It thinks I’m British. It’s paying me in pounds,” he said earlier this year.

Why creators need FIs to act

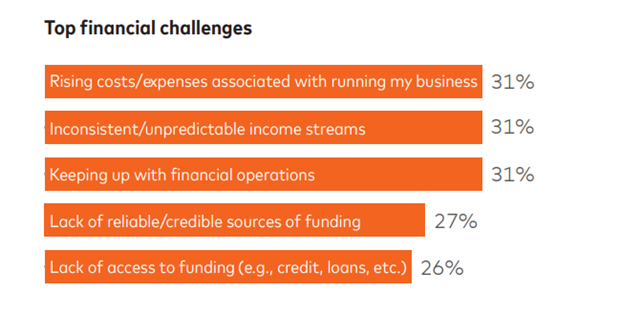

Given that financial motivations are a top driver for most people to enter the creator economy, the lack of financial products keeps them from enjoying the fruits of their labor. Payments are at the heart of it all.

———————————————————————————————–

If you want to keep reading please consider becoming a TS Pro subscriber by clicking below.